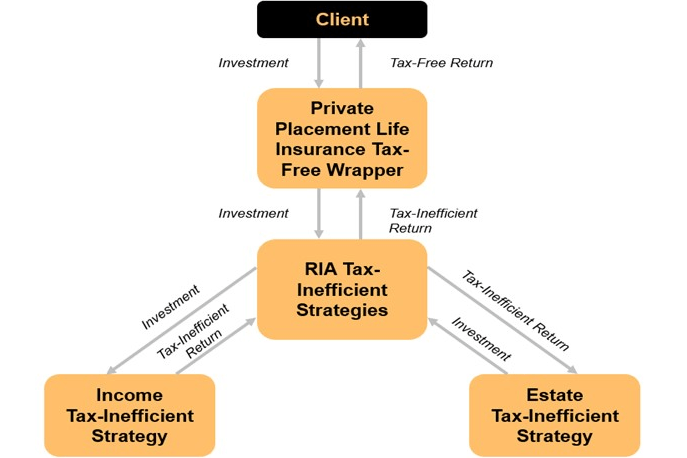

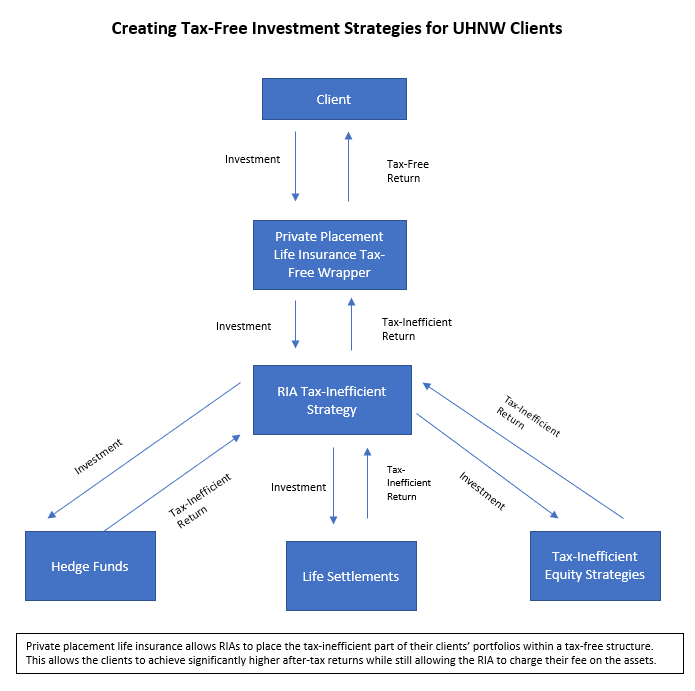

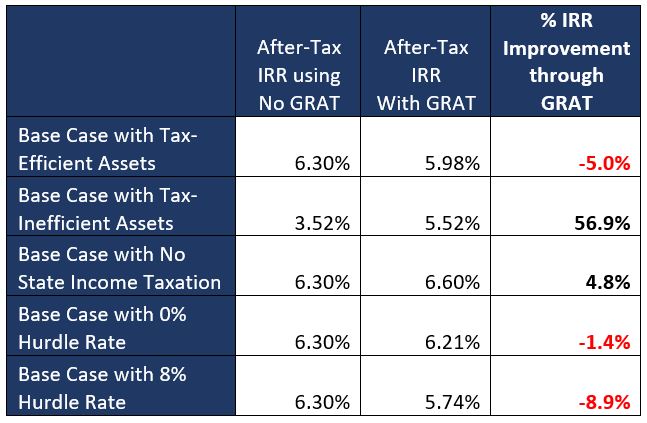

When it comes to optimizing investment strategies, one of the most powerful vehicles that ultra-high-net-worth (UHNW) individuals often use is a Private Placement Life Insurance (PPLI) policy. While many investors are familiar with taxable accounts, the world of PPLI...