Understanding the Value of Whole Life Insurance

Are you thinking of purchasing a whole life insurance policy and want to ensure you’re getting the best policy possible and using the features of the policy to your advantage?

What is Whole Life Insurance?

Whole life insurance is a form of permanent life insurance coverage that provides life insurance coverage for the life of the insured as long as the whole life insurance premiums are paid on time. The premiums are the same every year and guaranteed to keep the policy in force. For this reason, whole life insurance is the safest of all permanent life insurance products.

Whole life insurance also has a cash value component to it. You can think of cash value like a savings account. When you pay your whole life insurance premiums, part of your premium is going to pay for the cost of the life insurance and the rest is accruing in this savings account. The interest rates in the early years of this savings account is very low. However, in the later years they are fairly high.

For this reason, it’s very important that clients who own a whole life insurance policy plan on keeping it for the long-term. In fact, it often takes 5-15 years just to break even on your investment in a whole life insurance policy (the better it is structured, the earlier the break even point is).

The other benefit to whole life insurance is that unlike a savings account, the interest earned on a whole life insurance product is tax-free. You can also take out up to 90% of your principal and gains tax-free and leave the rest to your beneficiaries tax-free as well. This is a major benefit over traditional savings accounts at banks which are subject to ordinary income taxation. If you live in states with high income taxes like California or New York, you can end up paying more than 50% of the interest you earn from a bank savings account in taxes.

What Long-Term Interest Rates Can I Expect to Earn in Whole Life?

Policyowners in whole life insurance can expect to earn 4.5%-5% tax-free over the long-term while having the ability to withdraw money tax-free as described above. Compared to short-term bank yields that are in the 4.5%-5% but fully taxable, whole life offers policyowners the ability to invest for the long-term and stable tax-free yields that are significantly higher than what policyowners would earn in a bank account.

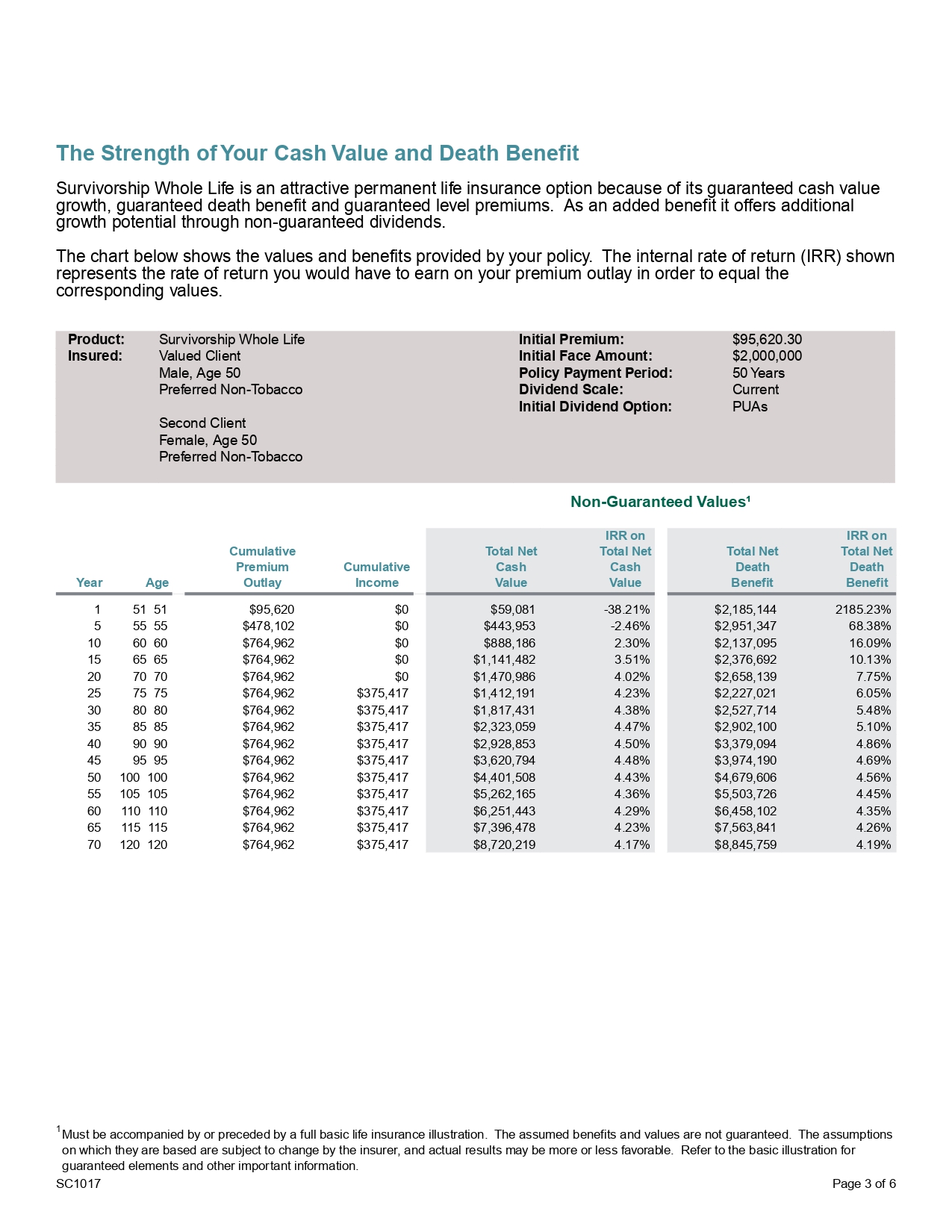

We can see this easily by looking at an actual sales illustration from the carrier.

Maximizing Whole Life Insurance IRRs

| Year | Age At End of Year | Cumulative Premium Outlay | Cumulative Income | Cumulative After-Tax Account Value | Cumulative After-Tax IRR |

|---|---|---|---|---|---|

| 1 | 51 | $95,620 | $0 | $59,081 | -38.21% |

| 5 | 55 | $478,102 | $0 | $443,953 | -2.46% |

| 10 | 60 | $764,962 | $0 | $888,186 | 2.30% |

| 15 | 65 | $764,962 | $0 | $1,141,482 | 3.51% |

| 20 | 70 | $764,962 | $0 | $1,470,986 | 4.02% |

| 25 | 75 | $764,962 | $375,417 | $1,412,191 | 4.23% |

| 30 | 80 | $764,962 | $375,417 | $1,817,431 | 4.38% |

| 40 | 90 | $764,962 | $375,417 | $2,928,853 | 4.50% |

| 50 | 100 | $764,962 | $375,417 | $4,401,508 | 4.43% |

By properly structuring a whole life insurance policy, clients can achieve a 4%-4.5% long-term IRR while still being able to withdraw almost half the total premium they put into the policy.

In the above example, a 50 year old client pays $95,620 per year into a whole life insurance policy for a total of 8 years (for a total cumulative premium of $764,962). At the end of year 20, they take out $375,417 tax-free for their retirement needs.

In the above example, we can see that while the early year IRRs are low, if the client keeps the policy for the long-term they are earning a 4%-4.5% long-term tax-free IRR while still being able to withdraw half the premiums they put into the policy to meet their retirement needs.

The catch here is that investors have to be willing to invest for at least 15-20 years and must utilize the right policy and structure it properly. To learn more about how to structure a whole life insurance policy properly by utilizing paid-up additions read our blog post here.

What are the Risks of Whole Life Insurance?

Whole life insurance doesn’t come without risks. The biggest risk here is that you end up canceling the policy early. In fact, according to Society of Actuaries’ studies, nearly 50% of policy owners will cancel their policy within 10 years. Due to high expenses and surrender charges these policy owners will often walk away from the policy with less money than they put in. So policyowners who cancel the policy are getting a horrible investment. However, because these policyowners are canceling the policy and walking away with less than they invested, the policyowners who keep the policy for the long-term are benefitting. This is because the insurance company is essentially sharing the profits in the later years through dividends with the policyowners who have kept the policy. So long-term policyowners benefit from the policy at the expense of short-term policyowners.

Another risk of whole life insurance is that not all policies are the same. Policies from different life insurance companies can be vastly different. So it’s important to compare multiple policies from different carriers and see what the IRRs are after 20-30 years. Some carriers have really poor IRRs and don’t show them on their illustrations for this reason. Unless potential policyowners are looking for this, they won’t realize that they’re getting a poor deal.

Finally, structuring whole life insurance properly is extremely important. Maximizing paid up additions as opposed to regular commissionable whole life insurance can be the difference between getting an after-tax 4.5% return vs an after-tax 2% return.

The problem is that most agents want to maximize their commission—even if that hurts the clients. So given the option, most agents will choose to maximize their commission as opposed to minimizing their commission to improve clients’ returns.

That’s why it’s important to utilize a life insurance agent that is willing to maximize the return you get from the policy—and not his or her commissions. This agent should be able to explain how whole life insurance premiums are structured and how they affect your long-term returns.

“That’s why it’s important to utilize a life insurance agent that is willing to maximize the return you get from the policy—and not his or her commissions.”

To learn more about how you can work with Colva to help you acquire and structure a policy that maximizes the return you get.