Private Placement Life Insurance: The Ultimate Estate And Investment Planning Tool

Private Placement Life Insurance (PPLI) can enable clients to avoid paying 35%+ total tax-rates on their gains, and instead pay ~10-15% in insurance costs—while protecting their assets from both creditors and estate taxes.

Are you an UHNW client or an RIA, family office, or estate attorney looking to protect your clients’ assets from income tax, estate tax, and creditors? If so, you should consider Private Placement Life Insurance (PPLI).

One of the best estate planning and investment tools available for ultra high net worth clients (UHNW), and the RIAs, family offices, and estate attorneys that serve them, is private placement life insurance (PPLI). PPLI is a life insurance financial planning tool that allows these UHNW clients (at least $10M in net assets) and their advisors the ability to move a large portion of their taxable estate outside of their estate so that those assets can grow tax-free and protected from creditors.

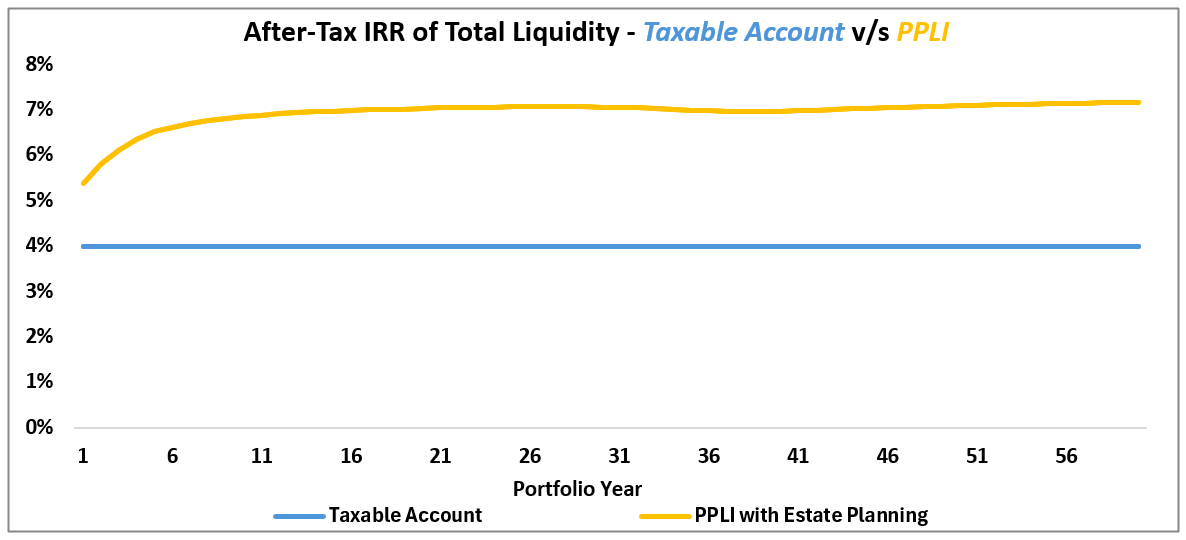

Instead of paying total state and income taxes of 30%+, clients pay insurance expenses that are only around 10%. This can increase a client’s after-tax IRR by 300 basis points or more—and that’s before accounting for estate taxes.

The ability for assets to grow tax-free is a major benefit over typical grantor annuity trust (GRAT) strategies in which all the gains from the assets are still taxable to the grantor even though the assets are outside of the estate. An even bigger concern here is that if the grantor dies before the end of the annuity term all of the assets in the trust are considered part of the grantor’s estate—thereby defeating the purpose of setting of up the GRAT in the first place.

Furthermore, all the assets in a PPLI receive a step-up in basis at death unlike in the case of grantor trust strategies. It’s also worth keeping in mind that in a high interest rate environment, grantor trust strategies are significantly reduced since the spread between the investment return of the assets and the amount that must be returned to the grantor are reduced.

| Estate Planning Tool | Assets Outside of the Estate | Ability to Take Loans for Liquidity | Tax-Free Growth | Step-Up in Basis at Death | Value Independent of Interest Rates |

| Grantor Trusts | x | x | |||

| PPLI | x | x | x | x | x |

PPLI offers a number of key advantages over grantor trust strategies: protection against early death of the grantor, tax-free growth, step-up in basis at death, and increased value in high interest rate environments

From an investment standpoint, the PPLI vehicle allows clients and their investment advisors the ability to move the tax-inefficient portions of their portfolio into a tax-free vehicle in order to maximize the after-tax return for the client.

This is a heavy value proposition for clients who either live-in states with high income taxes or have a portion of their portfolio in tax-inefficient assets. The added benefit here is that RIAs can charge their fee on the vehicle from within the vehicle on a pre-tax basis, thereby reducing the after-tax cost of their fee to the client.

PPLI Costs vs Total Tax Costs for Different States

| State/District | Highest State Income Tax Rate in 2024 | Highest Total Long-Term Capital Gains for State Residents | Highest Short-Term Capital Gains Tax-Rates for State Residents | Total PPLI Costs |

| California | 13.30% | 37.1% | 54.1% | ~10-15% |

| New York | 10.90% | 34.7% | 51.7% | ~10-15% |

| New Jersey | 10.75% | 34.6% | 51.6% | ~10-15% |

| Washington D.C. | 10.75% | 34.6% | 51.6% | ~10-15% |

| Oregon | 9.90% | 33.7% | 50.7% | ~10-15% |

| Minnesota | 9.85% | 33.7% | 50.7% | ~10-15% |

| Massachusetts | 9.00% | 32.8% | 49.8% | ~10-15% |

Certain states assess high marginal tax rates on short-term, long-term capital gains, and ordinary income rates—in addition to the federal tax rate residents pay. This means that high earning individuals in these states can end up paying more than 30%-50% of their gains in federal and state taxes which turns an otherwise tax-efficient asset into a tax-inefficient asset. Since the costs of a PPLI policy are typically less than 15% of the return, UHNW clients can achieve significant income tax savings (in addition to estate tax savings) by using a PPLI policy instead of investing through a taxable account.

By simply moving the part of clients’ portfolio that is subject to high federal and state income taxes to a tax-free vehicle, UHNW clients and their advisors can add nearly 300 basis points or more to their clients after-tax returns. And this doesn’t include the 40% estate tax savings from moving assets outside of the estate.

Taxable Account v/s PPLI End of Year Values

| Year | Age at End of Year | Total Contribution for Year | Taxable Account | PPLI with Estate Planning | ||

| After-Tax Total Liquidity at End of Year | After-Tax IRR of Total Liquidity at End of Year | After-Tax Total Liquidity at End of Year | After-Tax IRR of Total Liquidity at End of Year | |||

| 1 | 56 | $2,000,000 | $2,080,000 | 4.00% | $2,107,553 | 5.38% |

| 2 | 57 | $2,000,000 | $4,243,200 | 4.00% | $4,354,975 | 5.80% |

| 3 | 58 | $2,000,000 | $6,492,928 | 4.00% | $6,763,015 | 6.11% |

| 4 | 59 | $2,000,000 | $8,832,645 | 4.00% | $9,351,510 | 6.34% |

| 5 | 60 | $0 | $9,185,951 | 4.00% | $10,004,258 | 6.52% |

| 10 | 65 | $0 | $11,176,114 | 4.00% | $14,090,674 | 6.85% |

| 20 | 75 | $0 | $16,543,379 | 4.00% | $28,211,372 | 7.03% |

| 30 | 85 | $0 | $24,488,242 | 4.00% | $56,154,510 | 7.07% |

| 40 | 95 | $0 | $36,248,580 | 4.00% | $107,232,001 | 6.97% |

| 50 | 105 | $0 | $53,656,753 | 4.00% | $222,741,574 | 7.09% |

By placing tax-inefficient investments within a tax-free wrapper like PPLI and withdrawing money via tax-free loans, UHNW clients can improve after-tax returns by over 300 basis points compared to investing those assets in a taxable account over the long term. The longer the client waits to take the tax-free loan, the better the IRR. This assumes a gross return of 8% and a tax-rate of 50%.

If you are interested in exploring the benefits from PPLI

What is Private Placement Life Insurance (PPLI)?

Private placement life insurance (PPLI) is a vehicle that allows ultra-high net worth clients (10M+ net worth) to invest in assets and have the gains be free from both income tax and estate tax

What type of clients are the best fit for PPLI?

PPLI is the best fit for clients who have more than $10M in assets and meet one or more of the following criteria:

- Are looking for a solution to grow assets free from estate tax, income tax, and creditors

- Live in a state with a high income tax or have a total marginal tax rate on the assets they invest in that is above 30%

- Invest a part of their portfolio in tax-inefficient assets

- Are willing to wait 10-15 years before withdrawing their money or are saving for retirement

What are the steps involved in getting a PPLI policy?

In order to get a PPLI policy, clients will have to do the following:

1. Apply for and get approved for a life insurance policy from a carrier that provides PPLI and get medically underwritten

2. Choose investment managers and funds that are pre-approved with the carrier providing the private placement life insurance policy or select an investment manager of your choice to manage your investments—note that the investment manager will have to get approved by the carrier first.

What are the diversification requirements for a PPLI policy?

Regulation requires that the investment portfolio within the private placement life insurance (PPLI) policy be well diversified which means that at minimum, the portfolio must have 5 investment positions that abide by the following limitations:

- Any one investment position must not make up over 55% of the value of the portfolio

- Any two investment positions must not make up over 70% of the value of the portfolio

- Any three investment positions must not make up over 80% of the value of the portfolio

- Any four investment positions must not make up over 90% of the value of the portfolio

How do I get my money out of the PPLI policy before death?

There are two key ways to get money out of the policy before death of the insured: Full surrender of the policy, Withdrawals up to basis, loans for up to 90% of the cash surrender value:

- Full Surrender of the Policy:At any time, the policy owner can decide to cancel the PPLI policy and take their principal and gains out of the policy. The problem with this is that upon doing so, all the gains in the policy become taxable as ordinary income—which is the main problem the policyholder was trying to eliminate to begin with. Furthermore, life insurance policies—even cheap ones like PPLI policies—are typically front-loaded in the sense that in the early years the expenses are relatively high versus in the later years they are almost negligible. This means that the client typically needs to invest in the policy for at least 5-10 years before exiting the investment before the tax-deferral ability of the policy makes sense. So if the client completely exits the policy before 5-10 years, then they would have been better just investing in the assets directly and paying the taxes instead of investing in the policy and paying expenses. After 5-10 years, the policyholder can still invest in the policy and exit completely and come out ahead purely because of the benefits of tax-deferral.

- Withdrawals up to basis:The client is also free to take out their entire principal at any time without penalty—provided that the value of the investment portfolio is greater than the principal. This is similar to a Roth IRA that allows you the ability to withdraw your principal at any time—but not the gains. So for example, if the client has invested $2 million into the policy and the investment portfolio is now worth $3 million, the client can withdraw their $2 million in principal at any time without any penalties or taxes owed.

- Loans:While clients must can only withdraw up to the basis, they can take money out above this through the use of loans. In the best PPLI policies, clients can usually take up to 90% of the value of the policy through a combination of withdrawals up to the basis and loans. So in the previous example, if the value of the portfolio is $3M, with $2M in basis, the client can take up to ~$2M in basis, leaving $1M in the portfolio in gains. The client can then take about $700k in loans, leaving about $300k in the policy. So the total combination of withdrawals and loans is $2.7M which is 90% of the original $3M value.

Why must the policy owner and insured give up control over the investment decision regarding the investment with the PPLI policy?

When a client invests through a private placement life insurance policy, the insurance company is responsible for investing their money on the client’s behalf. The insurance company can outsource this investment management responsibility to a qualified investment manager of the client’s choosing, but that investment manager is responsible for making all the investment decisions.

The client is able to make high level recommendations for the investment manager, but the investment manager must have ultimate control and decision-making abilities and not merely be acting as an agent to execute the client’s wishes.

The reason for this delineation is that if the client maintains full control, then they are merely using the PPLI policy as a tax-shelter for their investment decisions as opposed to using it for the purpose of life insurance that it was intended to be. As such, there must be a clear delineation of control between the policyholder and the investment manager otherwise the PPLI policy is at risk of losing its tax benefits.

What are the risks of investing in assets through a Private Placement Life Insurance (PPLI) policy?

While PPLI has numerous benefits, there are also a number of risks and concerns that need to be addressed:

Active management:

A PPLI policy is not a “buy and forget about it” type of investment. Not only do the investments within the policy have to be managed, but so do the insurance costs. Failing to properly manage the policy can result in insurance costs escalating and eating up a lot of the tax-benefits of the PPLI policy.

Not all policies are the same:

Just like investments, not all private placement life insurance policies are the same. Some have different benefits than others, and some come with significantly more risks than others. It is important to have an insurance expert advise you on which PPLI policy is the best for your needs. Are you looking for maximum growth or the maximum liquidity? Are you ok with taking tail risk in exchange for investment flexibility? How do I measure the insurance expenses of 1 PPLI policy versus another. These are all questions that an insurance expert can help you assess.

Offshore vs onshore:

While offshore PPLI can have a lot of investment benefits and flexibility, it also tends to come with higher costs and less regulation. These are pros and cons that needed to be weighed in combination with the client’s goals.

For more information on private placement life insurance

You can also book a call with us here or reach out to us directly at [email protected]