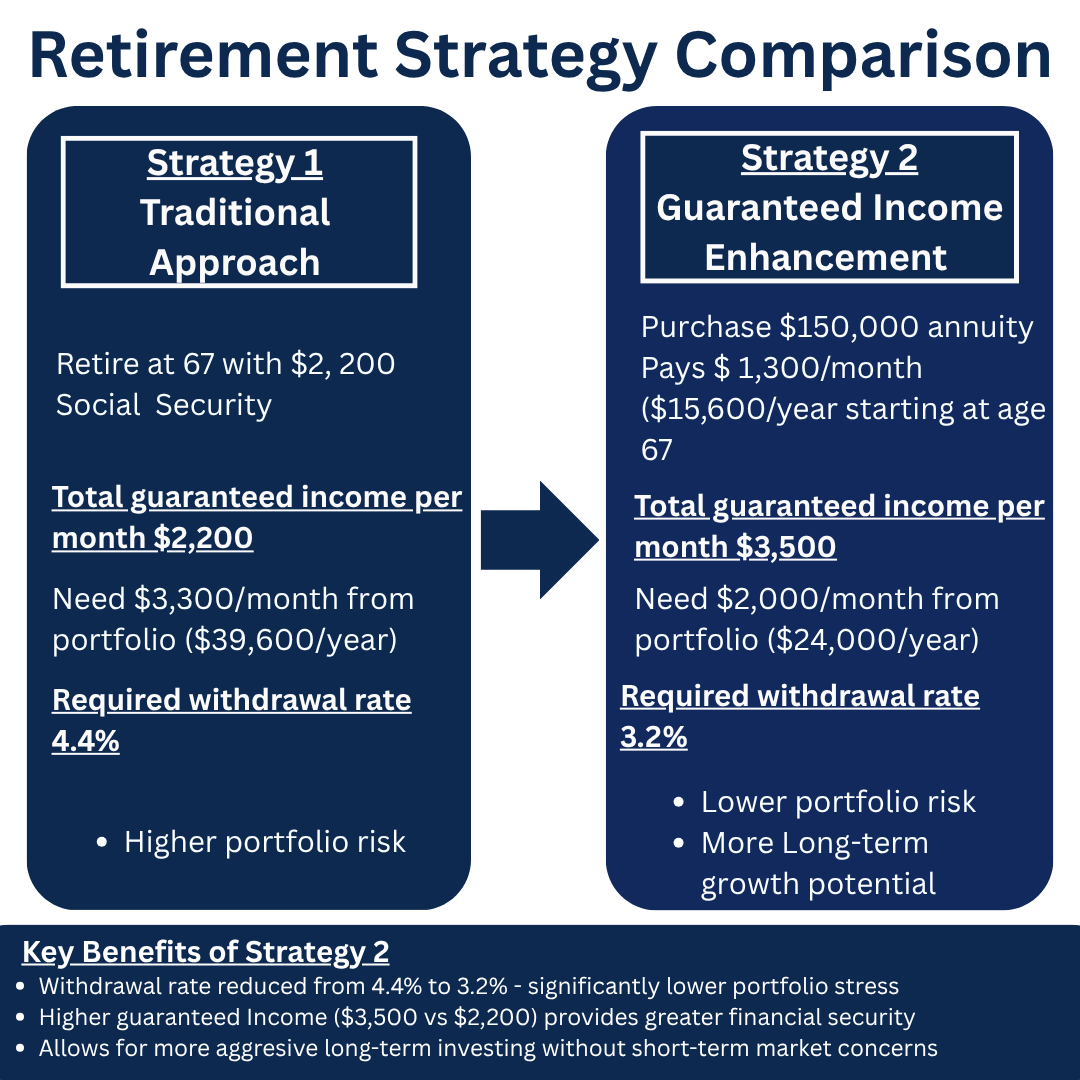

Discover how guaranteed lifetime income annuities can reduce your portfolio withdrawal rate from 4.4% to 3.2%, providing greater financial security and allowing for more aggressive long-term investing in retirement.

Discover how guaranteed lifetime income annuities can reduce your portfolio withdrawal rate from 4.4% to 3.2%, providing greater financial security and allowing for more aggressive long-term investing in retirement.

Large traditional IRAs create escalating tax burdens through required minimum distributions, beneficiary inheritance taxes, and rising future tax rates. Learn strategic solutions to minimize these costs.

Discover the hidden retirement tax break that could save you thousands: the 0% federal capital gains tax rate on up to $126,700 in investment gains. Most retirees don’t realize they can strategically sell their winning stocks and pay zero federal taxes on the profits. Learn how couples like Melissa and Jamie saved over $30,000 by timing their stock sales correctly, and discover the exact income thresholds and smart strategies to maximize this powerful benefit before you start collecting Social Security.

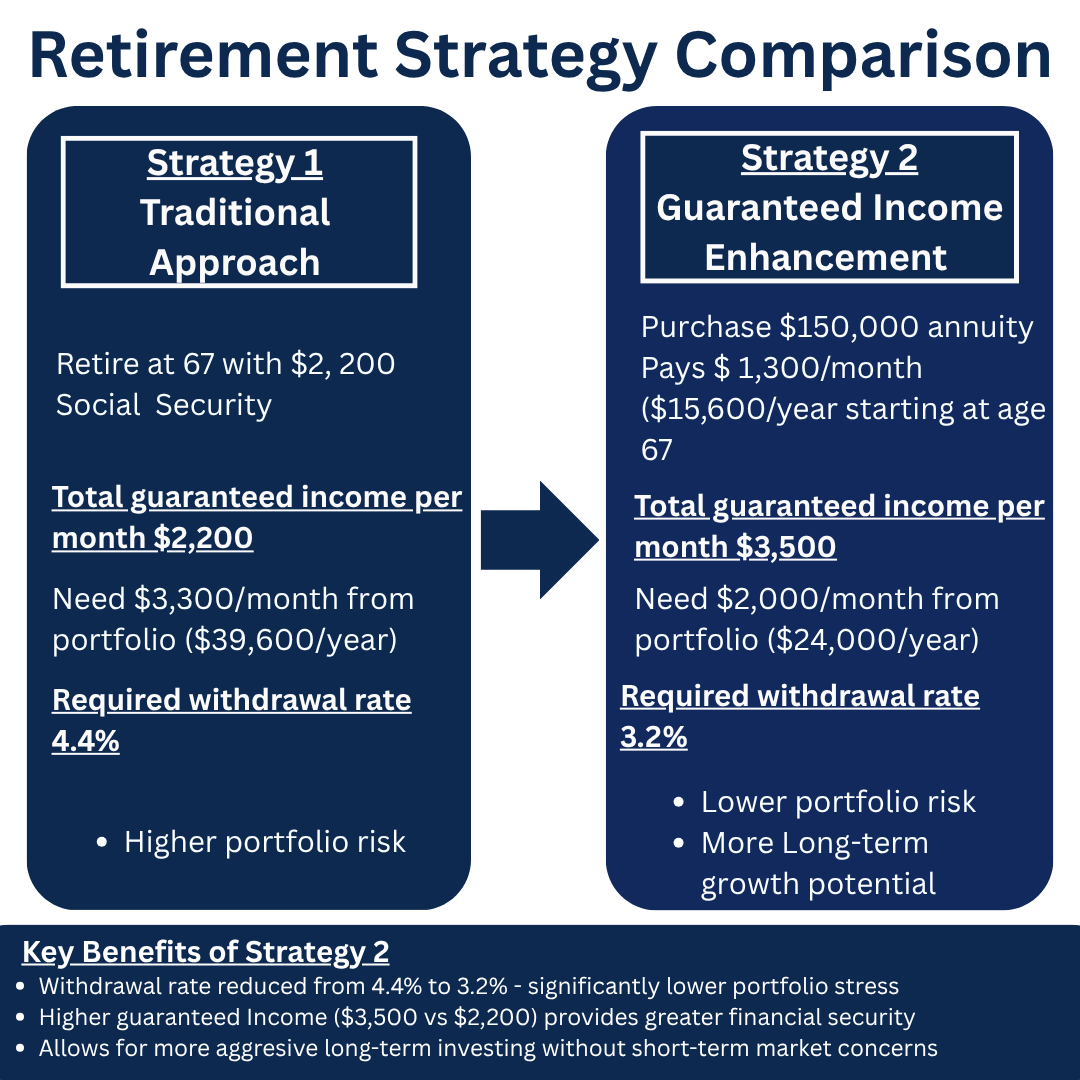

The choice to use an advisor in retirement is one that will cost clients and their beneficiaries millions of dollars in both fees and opportunity costs as we’ll show later in this article. If advisors are simply allocating clients to traditional stock-bond investment...

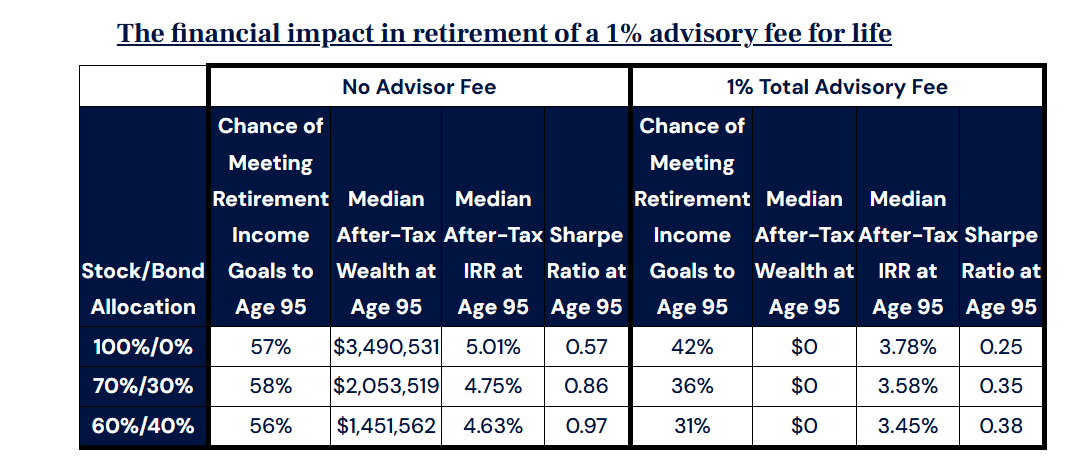

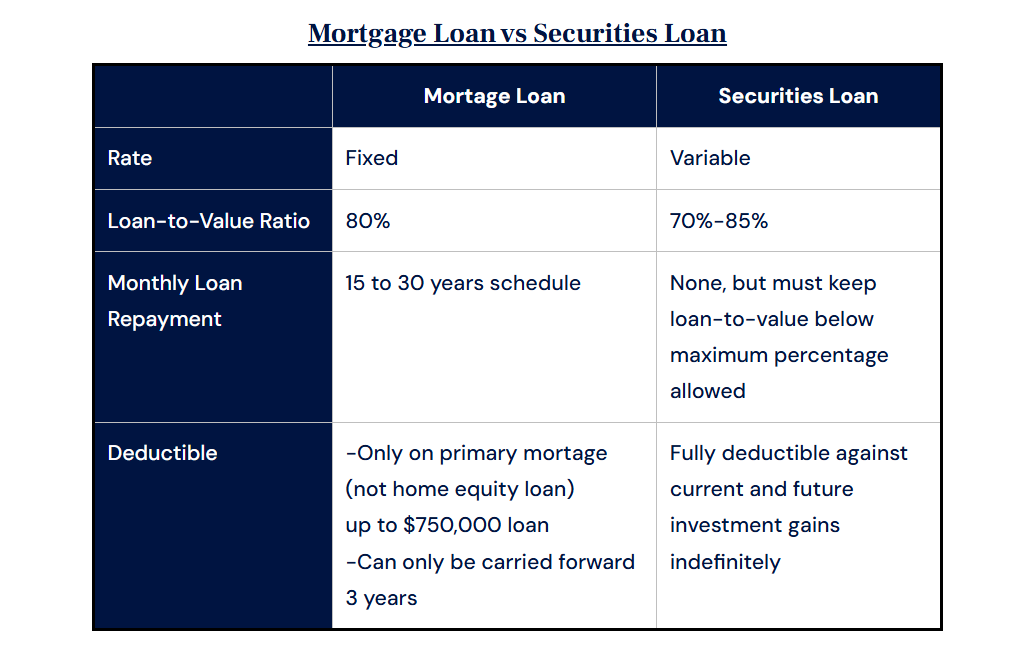

Anyone who has purchased a home is familiar with the concept of leverage. Most people when they purchase a home use 20% of their own money and borrow 80% from the bank. If the amount of appreciation on the home is more than the cost of the loan (and other costs of...

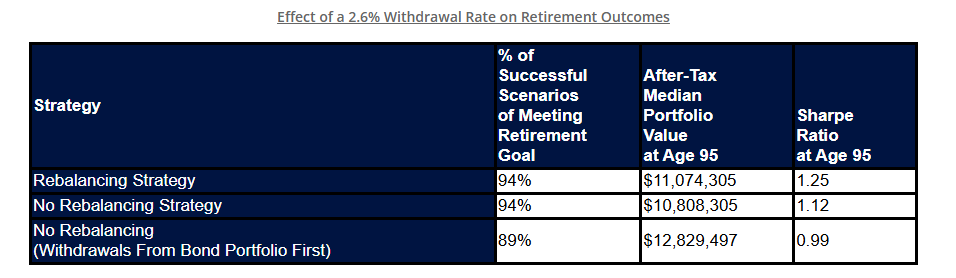

The traditional asset allocation glide path involves shifting client assets away from stocks and toward bonds as they near retirement. This approach reduces portfolio volatility and mitigates sequence of returns risk, potentially increasing the chance of meeting...

With interest rates at near 20 year highs, guaranteed lifetime income allows you the ability to lock-in these rates for the rest of your life while creating better retirement outcomesIf you own a home, then you’re probably wishing you had locked in a mortgage rate...

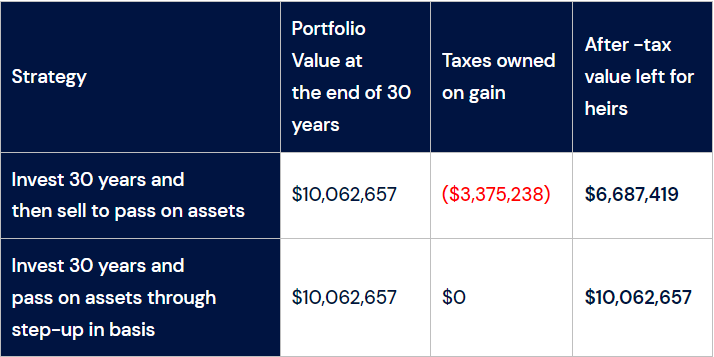

Depreciation allows real estate investors to get a tax deduction every year. The downside with it is that they have to pay back the deductions they took when they sell the property—unless they utilize step-up in basis provisions.

The Benefits of Multi-Year Guaranteed Annuities over Taxable Bonds and Bank CDs In a previous blog post, we talked about the downside of taxable bonds. Namely that they are tax-inefficient, subject to interest rate risk, and don’t always provide downside protection in...

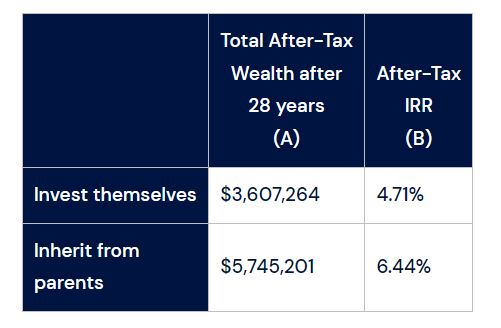

By using gifting strategies in place of contributing to a Roth IRA, high net worth clients can essentially replicate the benefits of a Roth IRA with larger contribution amounts and earlier withdrawal privileges.