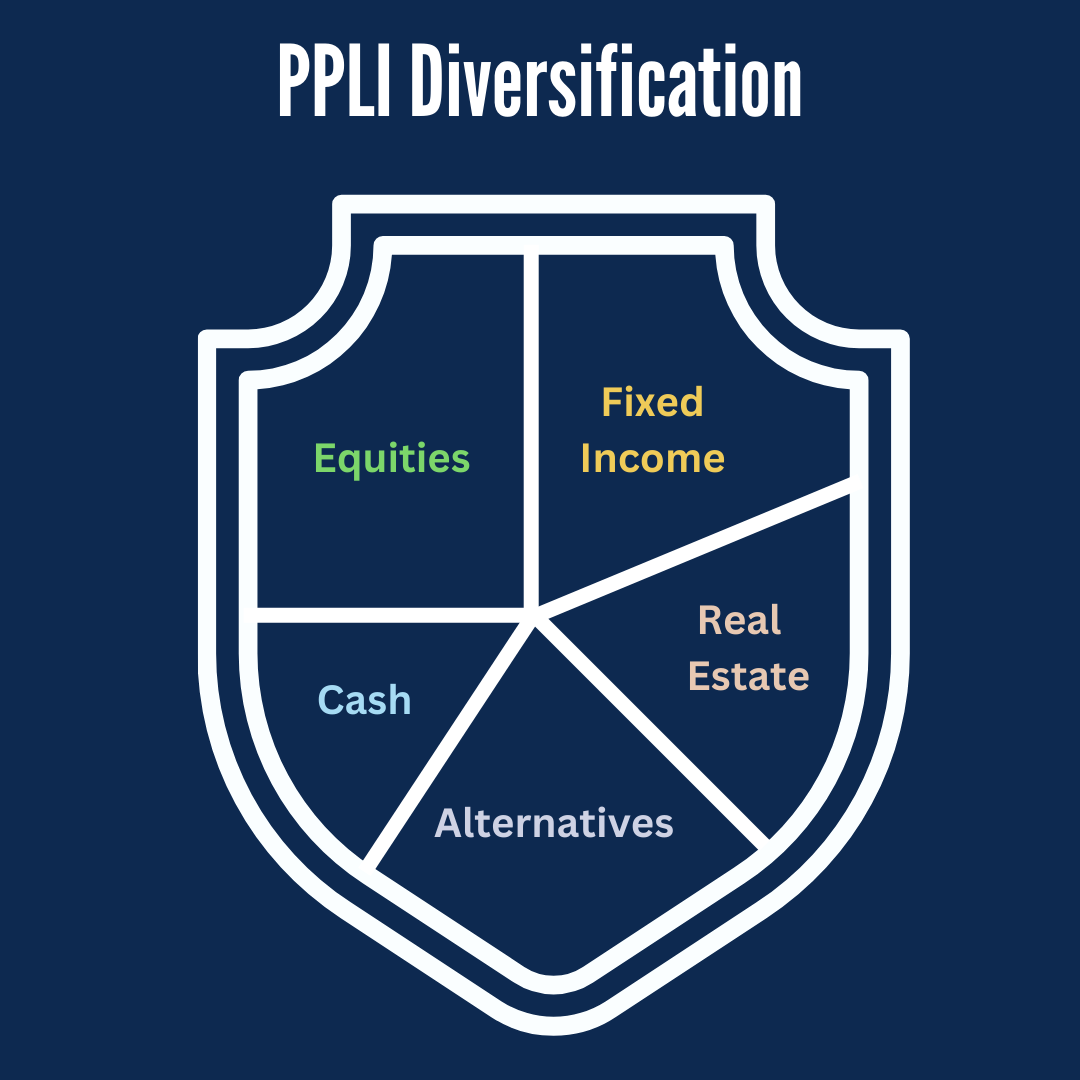

High-net-worth investors lose millions to annual tax bills that erode portfolio returns. Private placement life insurance (PPLI) eliminates this tax drag by allowing investments to grow tax-free, providing tax-free access through policy loans, and transferring wealth to heirs without income taxes—transforming lost tax payments into meaningful wealth accumulation.