Learn how to lock in TAX-FREE 4%-4.5% long-term returns for your retirement plan!

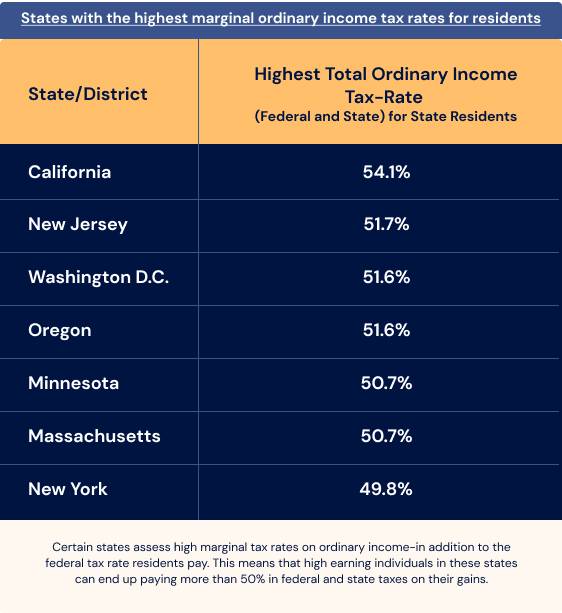

Are you a doctor, engineer, lawyer, business owner, or other high income earner living in states like California or New York with high state taxes?

If so, you’re probably losing 35%-50%+ of your investment gains to taxes.

Protecting Your Wealth with Whole Life Insurance

Taking risk with your investments is necessary to grow wealth. In fact, the more risk you take the more you can grow your wealth.

But taking too much risk can also lead to you losing your wealth.

So targeting an 8% pre-tax return that only gets you 4% after-tax is not so attractive if it that investment exposes you to a large chance of loss.

A whole life insurance policy can get you that same 4%-4.5% after-tax return without that level of risk.

After decades spent growing your wealth to get where you are now, how are you protecting it going forward?

Whole life offers the same tax-free benefits of a Roth IRA

A Roth IRA is a great way to invest in safe assets and not pay taxes.

But if you’re a high income earner, you’re not able to invest in this retirement vehicle.

So how does a high income earner invest in safe assets and not pay taxes?

Whole Life Insurance: Investing in Safe Assets without Paying Taxes for High Net Worth Individuals

Whole life insurance allows high net worth individuals who are phased out of contributing to Roth IRAs to invest in safe assets tax-free.

The underlying investments in a whole life insurance policy are very safe A grade long-term bonds without interest rate risk.

These safe investments within a tax-free investment allow policyowners the ability to earn 4%-4.5% tax-free as shown in the illustration below:

Example Whole life policy structured to earn 4%-4.5% tax-free

Using Whole Life Insurance for Tax-Free Retirement Income Allows for Better Planning

The more tax-free retirement income a client is able to receive, the less he or she has to pay taxes on the rest of the income he or she needs in retirement.

Since the tax system is a progressive one, the more income an individual makes the larger the amount of income that client will lose to taxes.

So using a whole life policy for tax-free retirement income, reduces the percentage of a client’s income that he or she loses to taxes!

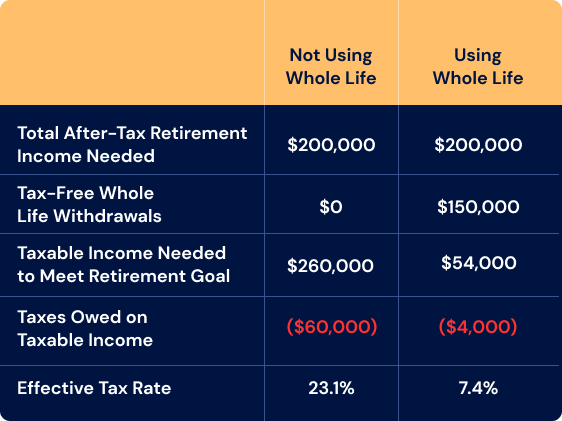

Case Study Analysis: John and Sally, both 55 living in California

Let’s say both John and Sally are single in California, retired and need $200,000 of after-tax income.

How much pre-tax income do they need to get this $200,000 in after-tax income?

Reducing retirees effective tax-rate by utilizing tax-free whole life distributions

Assuming that all of their income is taxed at ordinary income rates, they would need $260,000 in taxable income to meet this goal.

In other words, John and Sally are losing 23.1% of their income, or $60,000, to taxes!

By using whole life insurance for their withdrawals instead, John and Sally are saving $60,000!

If John and Sally are in California’s highest tax-bracket of 54.1%, they would be saving more than double this!

Why Colva?

If you understand the value of whole life insurance, you might be wondering why you should go with Colva.

Colva is first and foremost an actuarial group. This means we use our expertise in having designed and priced life insurance policies to show you, the client, how to get the highest return from your policy.

We’ve worked with clients worth over $100M to everyday doctors, lawyers, and engineers showing them exactly how to do this.

We are committed to showing wealthy clients how they can utilize life insurance products like whole life to reduce the risk in their investments, reduce the taxes they pay, improve their after-tax returns, and most importantly, INCREASE the amount of money they can spend in retirement!