Private placement life insurance (PPLI) policies present unique concentration risk challenges that require careful diversification strategies to optimize performance and protect policyholder interests. Concentration risk in PPLI can manifest through excessive exposure to single investment managers, asset classes, geographic regions, or market sectors within the policy’s investment platform. Effective diversification strategies for private placement life insurance help mitigate these risks while maintaining the tax advantages and investment flexibility that make PPLI an attractive wealth management tool for high-net-worth individuals and families.

Understanding Concentration Risk in PPLI Structures

Concentration risk within private placement life insurance policies occurs when policy assets become overly dependent on specific investments, managers, or market factors that could negatively impact overall performance. Unlike traditional investment portfolios where diversification is explicitly managed, PPLI policies can inadvertently develop concentration risks through manager selection, asset allocation decisions, or structural limitations within the insurance platform. These concentration risks can amplify losses during market downturns and reduce the overall risk-adjusted returns of the policy over time.

The nature of PPLI investment platforms can contribute to concentration risk through limited manager availability, high minimum investments, or policyholder preferences for familiar investment strategies. Many PPLI policies begin with concentrated positions that reflect the policyholder’s existing investment preferences or business interests, creating inherent concentration risks that require active management and strategic diversification over time.

Identifying concentration risk requires ongoing analysis of policy investments across multiple dimensions, including asset class exposure, geographic distribution, manager concentration, and correlation patterns among underlying investments. This analysis helps policyholders and their advisors understand where concentration risks exist and develop appropriate diversification strategies to address these exposures.

Asset Class Diversification Within PPLI Policies

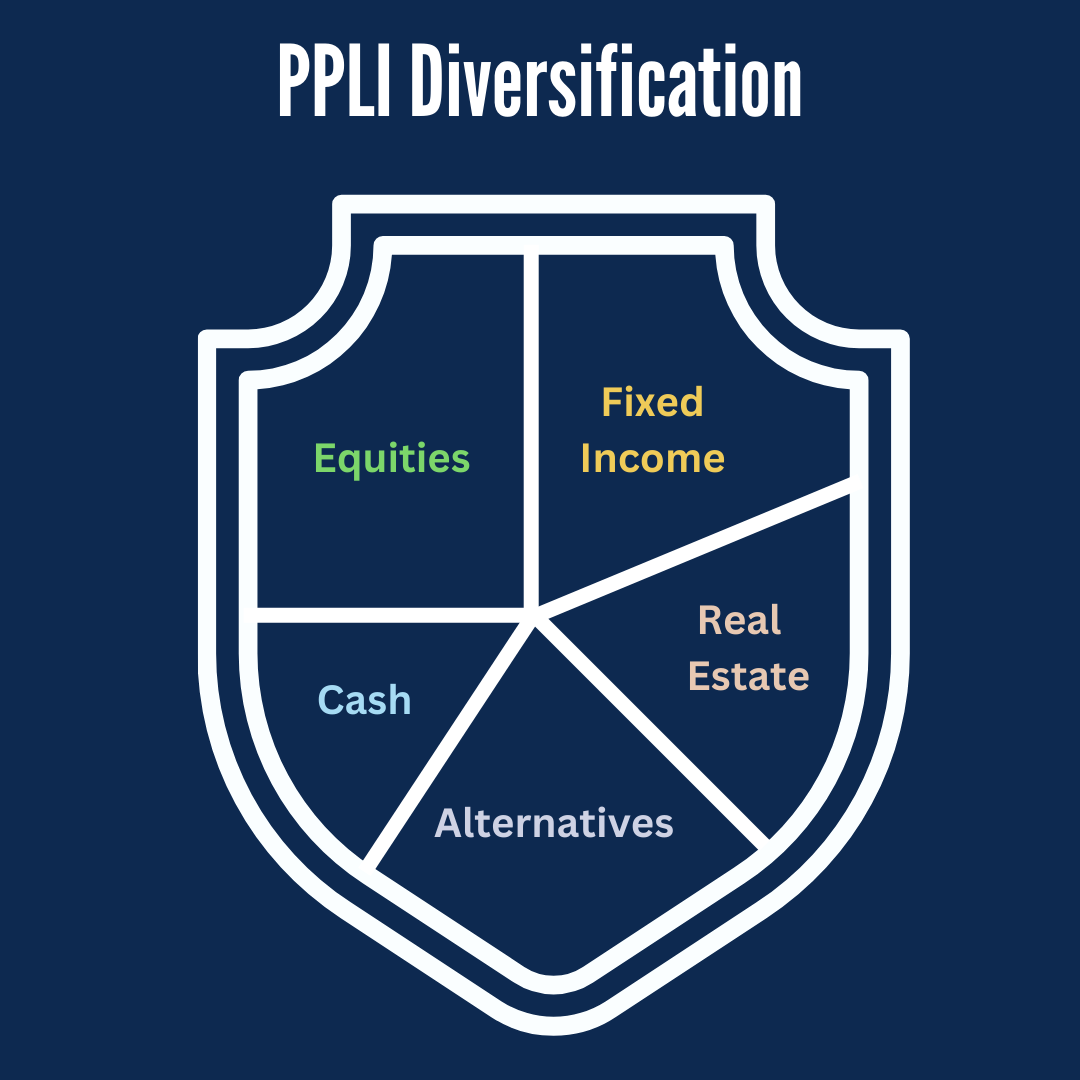

Effective asset class diversification represents a fundamental strategy for managing concentration risk within private placement life insurance policies. Traditional asset classes such as equities, fixed income, real estate, and commodities each offer different risk and return characteristics that can help reduce overall portfolio volatility when combined appropriately. The key is to achieve meaningful exposure to diverse asset classes while respecting the policy’s investment restrictions and maintaining tax efficiency.

Alternative investments available through PPLI platforms provide additional diversification opportunities beyond traditional asset classes. Private equity, hedge funds, infrastructure investments, and specialty lending strategies can offer returns that are less correlated with public market performance, potentially reducing concentration risk while enhancing overall policy returns. These alternative investments require careful due diligence and ongoing monitoring to ensure they contribute positively to the policy’s diversification objectives.

The allocation among different asset classes should reflect the policyholder’s risk tolerance, time horizon, and overall financial objectives while maintaining appropriate diversification across market cycles. Regular rebalancing among asset classes helps maintain target allocations and can enhance returns through systematic buying and selling discipline over time.

Geographic and Currency Diversification Strategies

Geographic diversification within PPLI policies helps reduce concentration risk related to specific countries, regions, or currencies that could impact policy performance. International investments can provide exposure to different economic cycles, monetary policies, and market conditions that may not be correlated with domestic market performance. This geographic spread can be particularly valuable for policies with long time horizons that will experience multiple market cycles.

Currency diversification through international investments or currency hedging strategies can provide additional risk management benefits for PPLI policies. Exposure to different currencies can serve as a natural hedge against domestic currency weakness while providing potential return enhancement during periods of relative currency strength. The decision to hedge or maintain currency exposure should be based on the policyholder’s overall currency risk profile and investment objectives.

Emerging market investments within PPLI policies can provide additional diversification benefits, though these investments typically carry higher volatility and require careful sizing within the overall policy allocation. The potential for higher long-term returns from emerging markets must be balanced against increased risk and the policy’s overall risk management objectives.

Have Questions?

Contact us by filling the form, and we’ll get back to you soon!

Contact Us

Manager and Strategy Diversification

Diversification across multiple investment managers represents a critical strategy for reducing concentration risk within private placement life insurance policies. Relying on a single manager or small number of managers creates concentration risk related to their investment approach, decision-making process, and potential operational issues. Spreading investments across multiple managers with different investment styles, philosophies, and areas of expertise can help reduce these concentration risks.

Manager selection for PPLI policies should consider not only investment performance but also the correlation between different managers’ approaches and their potential contribution to overall policy diversification. Combining growth and value managers, active and passive strategies, or fundamental and quantitative approaches can provide diversification benefits that enhance risk-adjusted returns over time.

Style diversification within PPLI policies helps ensure that performance is not overly dependent on specific market conditions or investment themes. Different investment styles perform better in different market environments, and maintaining exposure to diverse approaches can help smooth policy returns over time while reducing concentration risk related to any single investment philosophy.

Sector and Industry Risk Management

Industry and sector concentration represents a significant risk factor for many PPLI policies, particularly when policyholders have business interests or investment preferences that create natural sector biases. Technology, healthcare, financial services, and other sectors can experience significant volatility that affects all companies within the sector, regardless of individual company fundamentals. Managing sector concentration requires ongoing monitoring and active rebalancing to maintain appropriate diversification.

The cyclical nature of many industries creates additional concentration risks that must be managed over the policy’s lifetime. Industries that perform well during economic expansions may underperform during recessions, and maintaining diversification across cyclical and defensive sectors can help reduce this concentration risk. Regular sector allocation review and rebalancing helps ensure that policy investments remain appropriately diversified across different industry cycles.

Emerging sectors and disruptive technologies present both opportunities and concentration risks for PPLI policies. While these investments can provide significant growth potential, they often involve higher volatility and correlation during market stress periods. Careful sizing and ongoing monitoring of exposure to emerging sectors helps capture growth opportunities while managing concentration risks.

Risk Factor Diversification and Correlation Management

Understanding and managing risk factor exposure represents an advanced approach to concentration risk management within private placement life insurance policies. Risk factors such as interest rate sensitivity, credit risk, equity market exposure, and volatility risk can create hidden concentration that is not apparent from traditional asset allocation analysis. Regular risk factor analysis helps identify and address these hidden concentration risks.

Correlation analysis among policy investments helps identify potential concentration risks that may not be apparent from asset allocation alone. Investments that appear diversified on the surface may be highly correlated during market stress periods, creating concentration risk when it is least desirable. Understanding these correlation patterns helps guide investment selection and allocation decisions within the policy.

Factor-based investing approaches available through some PPLI platforms can provide more precise control over risk factor exposures and help reduce unwanted concentration risks. These approaches focus on systematic exposure to specific risk factors while managing unintended biases that can create concentration risk within traditional investment approaches.

Liquidity Management and Diversification

Liquidity diversification within PPLI policies helps ensure that the policy can meet distribution needs and manage cash flows without being forced to liquidate investments at unfavorable times. Maintaining appropriate allocation to liquid investments provides flexibility for policy management while allowing for strategic allocation to less liquid investments that may offer higher returns over time.

The liquidity profile of PPLI investments should reflect the policy’s expected distribution patterns and the policyholder’s potential needs for policy access. Policies that may require regular distributions or partial surrenders need higher liquidity allocations than policies designed for long-term accumulation without distributions.

Alternative investment liquidity terms vary significantly and can create concentration risk if not properly managed. Private equity, real estate, and other alternative investments often have limited liquidity during certain periods, and overallocation to illiquid investments can create concentration risk related to the policy’s ability to access cash when needed.

Monitoring and Rebalancing Strategies

Effective concentration risk management requires ongoing monitoring of policy investments and regular rebalancing to maintain target diversification levels. Market movements can cause asset allocations to drift from target levels, creating unwanted concentration risks that require attention. Regular monitoring helps identify when rebalancing is needed to restore appropriate diversification levels.

Rebalancing frequency and methodology should reflect the policy’s investment objectives and the volatility of underlying investments. More volatile investments may require more frequent monitoring and rebalancing, while stable investments may require less frequent attention. The costs and tax implications of rebalancing within PPLI policies are generally minimal, allowing for more frequent rebalancing than in taxable accounts.

Systematic rebalancing approaches can help remove emotion and market timing considerations from the rebalancing process while ensuring that concentration risks are managed consistently over time. These approaches can be based on time intervals, allocation drift thresholds, or market volatility measures depending on the policy’s specific characteristics and objectives.

Technology and Tools for Risk Management

Modern portfolio management technology available through PPLI platforms provides enhanced tools for monitoring and managing concentration risk within policies. These tools can provide real-time analysis of asset allocation, risk factor exposure, and correlation patterns that help identify concentration risks before they become significant problems. Regular use of these analytical tools enhances the effectiveness of diversification strategies.

Risk reporting and analytics capabilities help policyholders and their advisors understand the risk characteristics of policy investments and identify areas where additional diversification may be beneficial. These reports can highlight concentration risks that may not be apparent from traditional performance reporting and help guide strategic allocation decisions.

Integration between portfolio management systems and policy administration platforms allows for more efficient implementation of diversification strategies and rebalancing activities. This integration can reduce operational friction and help ensure that diversification strategies are implemented effectively over time.

Best Practices for PPLI Diversification

Successful diversification within private placement life insurance policies requires a systematic approach that considers multiple risk factors and maintains discipline over time. Regular portfolio review and analysis helps ensure that diversification strategies remain effective as markets change and the policy matures. Professional guidance from experienced investment advisors familiar with PPLI structures is essential for optimal implementation.

Documentation of diversification objectives and strategies helps ensure consistency in policy management over time and provides a framework for evaluating potential investment changes. Clear investment guidelines and constraints help prevent inadvertent concentration risk while maintaining flexibility for strategic opportunities.

Regular communication between policyholders and their advisors helps ensure that diversification strategies remain aligned with changing objectives and circumstances. The long-term nature of PPLI policies requires ongoing attention to ensure that diversification strategies continue to meet the policyholder’s needs over time.

Conclusion

Managing concentration risk within private placement life insurance policies requires careful attention to diversification across multiple dimensions, including asset classes, managers, geographic regions, and risk factors. Effective diversification strategies help protect policy performance while maintaining the tax advantages and investment flexibility that make PPLI attractive for high-net-worth families. The key is to implement systematic approaches to diversification that can be maintained and adjusted over the policy’s lifetime.

Regular monitoring and professional guidance are essential for successful concentration risk management within PPLI policies. The combination of sophisticated investment platforms and professional oversight can help ensure that diversification strategies remain effective over time while adapting to changing market conditions and policyholder objectives.

Ready to Optimize Your PPLI Diversification Strategy?

Book a Call

0 Comments