7. Explore premium financing strategies for PPLI to maximize wealth creation through leverage. Learn how private placement life insurance financing can multiply estate values while minimizing personal capital outlay

7. Explore premium financing strategies for PPLI to maximize wealth creation through leverage. Learn how private placement life insurance financing can multiply estate values while minimizing personal capital outlay

7. Discover how PPLI integrates with captive insurance companies for enhanced risk management. Learn strategies for combining private placement life insurance with captive structures for optimal wealth protection.

Learn about PPLI minimum investment requirements ranging from $1 million to $10 million across carriers. Discover factors determining thresholds and strategies for meeting private placement life insurance minimums effectively.

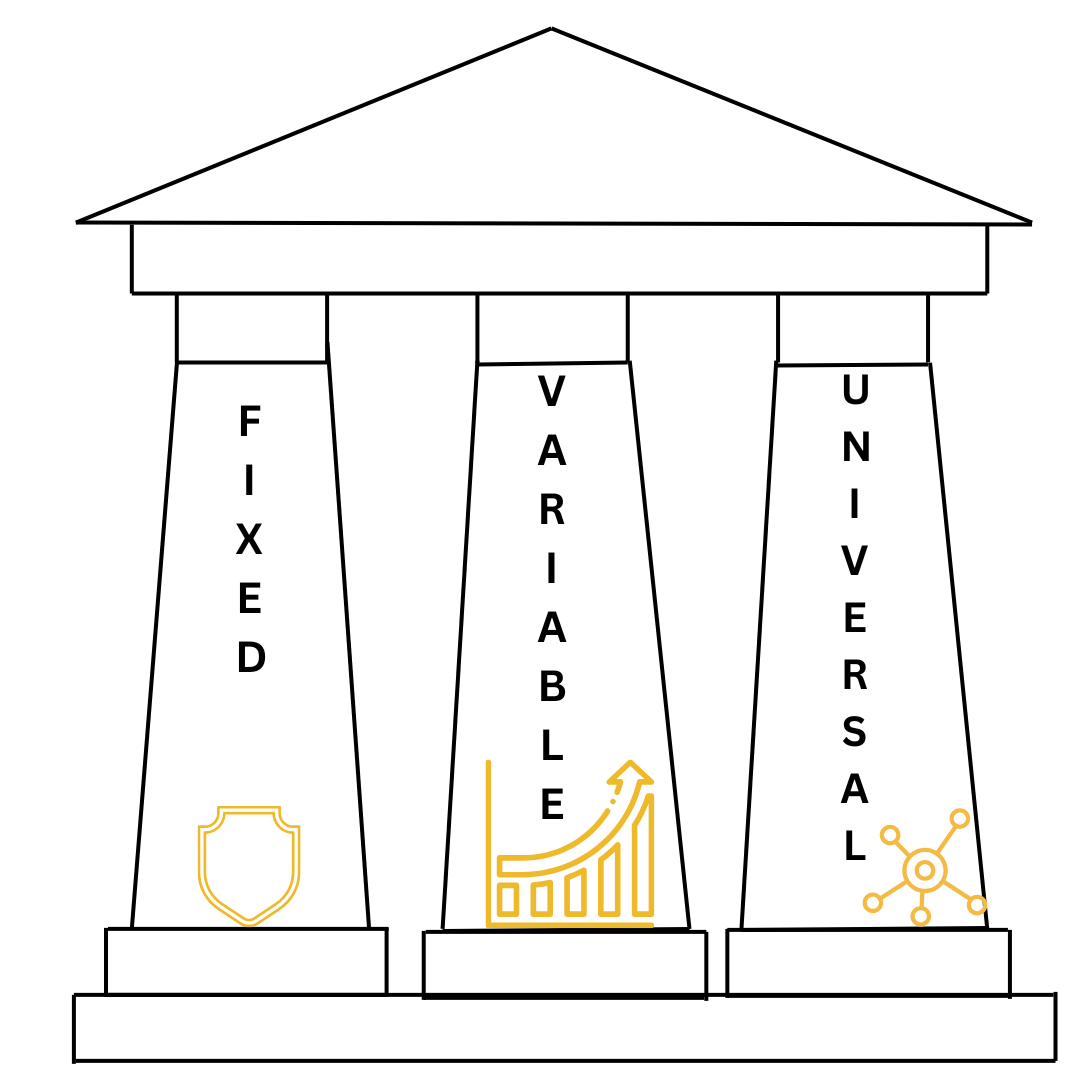

Discover the key differences between Fixed, Variable, and Universal Life platforms in Private Placement Life Insurance. This comprehensive guide breaks down investment flexibility, risk management features, premium payment options, and cost structures to help high-net-worth individuals choose the optimal PPLI platform for their wealth planning objectives. Learn how each platform type affects long-term policy performance and which option best aligns with your investment preferences and risk tolerance.

Learn how to evaluate PPLI carriers by balancing financial strength ratings against investment platform flexibility. Compare fee structures and long-term costs to select the optimal Private Placement Life Insurance carrier for your wealth strategy.

Discover how Private Placement Life Insurance transforms charitable remainder trust strategies into powerful wealth replacement tools. Learn tax-efficient approaches that maximize charitable benefits while preserving family wealth for high-net-worth families.

Maximize your PPLI policy’s potential by tracking essential performance metrics. Learn key indicators for investment returns, cost analysis, tax efficiency, and policy sustainability to ensure optimal wealth preservation outcomes.

Master essential best practices for PPLI investment committee governance. Learn to establish effective oversight structures, develop robust policies, and implement risk management frameworks that maximize wealth preservation while ensuring regulatory compliance.

Unlock the power of combining private placement life insurance (PPLI) with family limited partnership (FLP) structures for advanced wealth transfer strategies. Discover how ultra-high-net-worth families can leverage valuation discounts, tax-deferred growth, and multi-generational planning to transfer substantial wealth while minimizing estate and gift tax consequences. Learn the essential techniques for integrating these powerful structures to create lasting family legacies.

Hedge Fund Investments in PPLI: Benefits, Risks, and Due Diligence for Private Placement Life Insurance Strategies

Private placement life insurance (PPLI) has become an increasingly popular vehicle for high-net-worth individuals seeking to combine life insurance benefits with alternative investment strategies. Among the various investment options available within PPLI structures, hedge fund investments offer unique opportunities for portfolio diversification and enhanced returns. Understanding the benefits, risks, and due diligence requirements of hedge fund investments in private placement life insurance is essential for making informed decisions about this wealth management strategy.

## Understanding Hedge Fund Integration in PPLI Structures

Hedge fund investments within PPLI policies operate through carefully structured arrangements that maintain the insurance wrapper’s tax advantages while providing access to alternative investment strategies. These investments typically occur through dedicated funds or separately managed accounts designed specifically for insurance company separate accounts, ensuring compliance with regulatory requirements governing private placement life insurance.

The structure allows policyholders to access hedge fund strategies that might otherwise be unavailable or less tax-efficient in direct investment formats. Insurance companies work with established hedge fund managers to create insurance-dedicated versions of their strategies, often with modified fee structures and enhanced liquidity provisions tailored to the insurance environment.

PPLI hedge fund investments can encompass various strategies including long-short equity, event-driven approaches, relative value strategies, and macro trading. The insurance wrapper provides a tax-deferred growth environment where hedge fund returns can compound without immediate tax consequences, potentially enhancing long-term wealth accumulation compared to direct hedge fund investments.

## Tax Advantages and Wealth Preservation Benefits

The primary benefit of hedge fund investments within PPLI lies in the tax treatment of returns generated by these strategies. Traditional hedge fund investments typically generate significant taxable income through short-term capital gains, dividend income, and interest income, all of which are taxed at ordinary income rates. Within the PPLI structure, these returns accumulate tax-deferred, allowing for more efficient compound growth over time.

Estate planning benefits represent another significant advantage of hedge fund PPLI investments. The death benefit proceeds pass to beneficiaries income tax-free, effectively transferring hedge fund returns without the tax burden that would apply to direct hedge fund investments. This feature proves particularly valuable for families seeking to transfer wealth generated by alternative investment strategies to future generations.

The ability to access policy values through loans without triggering taxable events provides additional flexibility compared to direct hedge fund investments. Policyholders can access liquidity based on their hedge fund investment performance without the immediate tax consequences associated with hedge fund withdrawals or redemptions.

## Enhanced Diversification and Return Potential

Hedge fund strategies within PPLI offer portfolio diversification benefits that extend beyond traditional stock and bond investments. Market-neutral strategies, for example, can provide returns with low correlation to equity markets, helping to reduce overall portfolio volatility while maintaining growth potential.

Alternative risk premia strategies accessible through PPLI hedge fund investments can capture returns from various market inefficiencies and behavioral biases. These strategies often provide steady returns with different risk characteristics than traditional investments, contributing to more balanced portfolio performance across various market conditions.

The ability to combine multiple hedge fund strategies within a single PPLI policy creates opportunities for further diversification. Policyholders can allocate among different hedge fund managers and strategies, creating a fund-of-funds approach within the insurance wrapper while maintaining the tax benefits of the PPLI structure.

## Liquidity Considerations and Management

Hedge fund investments traditionally involve lock-up periods and limited redemption windows that can restrict investor access to capital. PPLI structures often negotiate enhanced liquidity provisions with hedge fund managers, including shorter lock-up periods, more frequent redemption opportunities, or side-pocket arrangements for illiquid investments.

Policy loan features provide additional liquidity options that bypass traditional hedge fund redemption restrictions. Policyholders can borrow against their policy values, including those supported by hedge fund investments, without triggering hedge fund redemptions or violating lock-up provisions.

The insurance company’s role in managing hedge fund redemptions within PPLI policies helps coordinate liquidity needs across multiple policyholders. This pooling effect can sometimes provide better redemption terms than individual investors might achieve in direct hedge fund investments.

## Risk Assessment and Management Strategies

Hedge fund investments within PPLI carry specific risks that require careful evaluation and ongoing monitoring. Manager risk represents a primary concern, as hedge fund strategies often depend heavily on the skill and discipline of individual portfolio managers. Due diligence must focus on manager track records, investment processes, and risk management capabilities.

Operational risk assessment becomes critical when evaluating hedge fund managers for PPLI investments. The insurance wrapper adds additional operational complexity, requiring hedge fund managers to maintain proper reporting, compliance, and administrative capabilities to support insurance company requirements.

Concentration risk can emerge when PPLI policies become heavily weighted toward hedge fund investments or specific hedge fund strategies. Diversification across multiple managers, strategies, and asset classes helps mitigate this risk while maintaining the benefits of alternative investment exposure.

## Due Diligence Framework for Hedge Fund Selection

Effective due diligence for hedge fund investments in PPLI requires analysis of both investment merits and insurance-specific considerations. Investment due diligence should evaluate the hedge fund manager’s investment philosophy, process consistency, and historical performance across different market cycles.

Operational due diligence must assess the hedge fund manager’s ability to operate within the insurance environment, including reporting capabilities, compliance infrastructure, and experience with insurance company separate accounts. The manager’s willingness to modify fee structures or provide enhanced liquidity for insurance applications represents important considerations.

Third-party due diligence resources, including hedge fund research platforms and specialized consultants, can provide valuable insights into manager capabilities and operational strengths. Insurance companies often maintain preferred manager lists based on their own due diligence processes, providing additional filtering for PPLI hedge fund investments.

## Fee Structure Analysis and Cost Management

Hedge fund investments within PPLI typically involve multiple fee layers that require careful analysis to understand total investment costs. Management fees and performance fees charged by hedge fund managers represent the primary investment costs, often following traditional “2 and 20” structures or variations thereof.

Insurance company charges add additional costs to hedge fund PPLI investments, including mortality and expense charges, administrative fees, and surrender charges. Understanding the interaction between hedge fund fees and insurance charges helps evaluate the total cost of accessing hedge fund strategies through PPLI.

Fee negotiations for hedge fund investments in PPLI sometimes result in reduced costs compared to direct hedge fund investments. The pooled nature of insurance company separate accounts and long-term investment horizons can provide leverage for better fee arrangements with hedge fund managers.

## Performance Monitoring and Reporting

Hedge fund investments within PPLI require specialized monitoring and reporting capabilities to track performance and ensure alignment with investment objectives. Monthly performance reporting should include both gross and net returns, attribution analysis, and risk metrics specific to the hedge fund strategy employed.

Benchmark comparisons become important for evaluating hedge fund performance within PPLI, though appropriate benchmarks vary by strategy type. Hedge fund indices, peer group comparisons, and risk-adjusted performance measures help assess whether hedge fund investments are delivering expected value within the insurance wrapper.

Regular portfolio reviews should evaluate the ongoing suitability of hedge fund investments within the broader PPLI policy structure. Changes in market conditions, investment objectives, or hedge fund manager capabilities may necessitate adjustments to hedge fund allocations or manager selections.

## Regulatory Compliance and Reporting Requirements

Hedge fund investments within PPLI must comply with various regulatory requirements governing both insurance products and alternative investments. Investor control restrictions ensure that policyholders maintain appropriate distance from investment decisions to preserve favorable tax treatment under private placement life insurance regulations.

Anti-money laundering and know-your-customer requirements apply to hedge fund investments within PPLI, requiring proper documentation and ongoing monitoring of beneficial ownership and source of funds. These requirements may be more stringent than direct hedge fund investments due to the insurance wrapper.

Tax reporting for hedge fund investments within PPLI occurs at the insurance company level, simplifying tax compliance for policyholders while maintaining transparency regarding underlying investment performance and tax characteristics.

## Integration with Overall Wealth Management Strategy

Hedge fund investments within PPLI should align with broader wealth management and estate planning objectives rather than serving as isolated investment decisions. The insurance death benefit, tax deferral features, and liquidity options must work together to support overall financial goals.

Coordination with other investment accounts helps optimize asset location and tax efficiency across the entire investment portfolio. Hedge fund strategies within PPLI may complement traditional investments held in taxable accounts or retirement plans, providing diversification benefits while maximizing tax efficiency.

Regular strategy reviews ensure that hedge fund investments within PPLI continue to serve their intended purpose as circumstances change. Market conditions, tax law modifications, or personal financial situations may affect the optimal allocation to hedge fund strategies within the insurance wrapper.

## Future Considerations and Market Developments

The hedge fund industry continues to develop new strategies and approaches that may become available within PPLI structures. Emerging areas such as digital assets, ESG-focused strategies, and quantitative approaches may offer additional opportunities for PPLI hedge fund investments.

Regulatory developments affecting either hedge funds or private placement life insurance may impact the attractiveness or structure of these investments. Staying informed about regulatory changes helps ensure continued compliance and optimal strategy implementation.

Technology improvements in hedge fund operations and insurance administration may enhance the efficiency and cost-effectiveness of hedge fund investments within PPLI. These developments could expand access to hedge fund strategies or improve the overall economics of combining hedge funds with insurance wrappers.

Hedge fund investments within private placement life insurance represent a powerful tool for wealth accumulation and estate planning when properly implemented and managed. The combination of tax advantages, diversification benefits, and professional management creates opportunities for enhanced long-term wealth creation. However, success requires careful due diligence, ongoing monitoring, and integration with broader wealth management strategies. By understanding the benefits, risks, and requirements of hedge fund PPLI investments, high-net-worth individuals can make informed decisions about incorporating these strategies into their overall financial plans.

Private placement life insurance (PPLI) provides affluent investors with unique opportunities to access alternative investment strategies while enjoying the tax advantages and wealth transfer benefits of life insurance structures. Unlike traditional life insurance...

Navigate the complexities of cross-border Private Placement Life Insurance ownership with expert guidance on international tax implications. Learn about U.S., EU, and Asian jurisdiction requirements, reporting obligations, and strategic planning considerations for globally connected families seeking optimal PPLI tax efficiency and compliance.