Private Placement Life Insurance (PPLI) offers high-net-worth individuals unique flexibility in premium payments, including the ability to fund policies using in-kind assets. This strategic approach…

Private Placement Life Insurance (PPLI) offers high-net-worth individuals unique flexibility in premium payments, including the ability to fund policies using in-kind assets. This strategic approach…

Discover how Private Placement Life Insurance (PPLI) evolved from a niche 1980s product to a sophisticated wealth planning tool. Learn about key developments in tax efficiency, investment flexibility, and modern applications in wealth management. Expert insights from Colva on maximizing PPLI strategies.

Discover the differences between Private Placement Life Insurance (PPLI) and traditional life insurance. Learn how PPLI offers high-net-worth individuals unparalleled investment flexibility, tax efficiency, and wealth management opportunities. Explore tailored solutions with Colva’s PPLI experts.

Private Placement Life Insurance (PPLI) is a transformative wealth management solution tailored for high-net-worth individuals. As traditional tax havens decline under global scrutiny, PPLI has emerged as a sophisticated strategy combining significant tax advantages, investment flexibility, and asset protection. Offering a unique blend of tax-deferred growth, estate planning benefits, and access to institutional-quality investments, PPLI empowers wealthy individuals to optimize their financial legacy while maintaining privacy and creditor protection.

Learn how PPLI’s innovative structure can revolutionize your wealth strategy—unlocking tax efficiency, investment opportunities, and enduring security for future generations. Explore PPLI with Colva Insurance Services today.

An in-depth guide to Insurance Dedicated Funds (IDFs) within Private Placement Life Insurance (PPLI) and PPVA products. Learn how these sophisticated investment vehicles operate, their tax advantages, IRS requirements, and strategies for high-net-worth investors seeking optimal wealth management solutions.

Discover Private Placement Life Insurance (PPLI): A sophisticated wealth management strategy for high-net-worth individuals offering tax efficiency, investment flexibility, and estate planning benefits. Learn how this $5M+ investment vehicle combines tax-advantaged growth with institutional-quality investment options for optimal wealth preservation.

Private Placement Life Insurance (PPLI) has gained increasing attention among high-net-worth individuals seeking tax-efficient investment solutions. This post will break down what PPLI is, how it works, and whether it might be right for you. What is PPLI? Private...

Discover how whole life insurance premiums work, from age and health factors to payment options and advanced strategies like paid-up additions. Learn how these premiums can serve as a versatile financial tool for protection, savings, and estate planning.

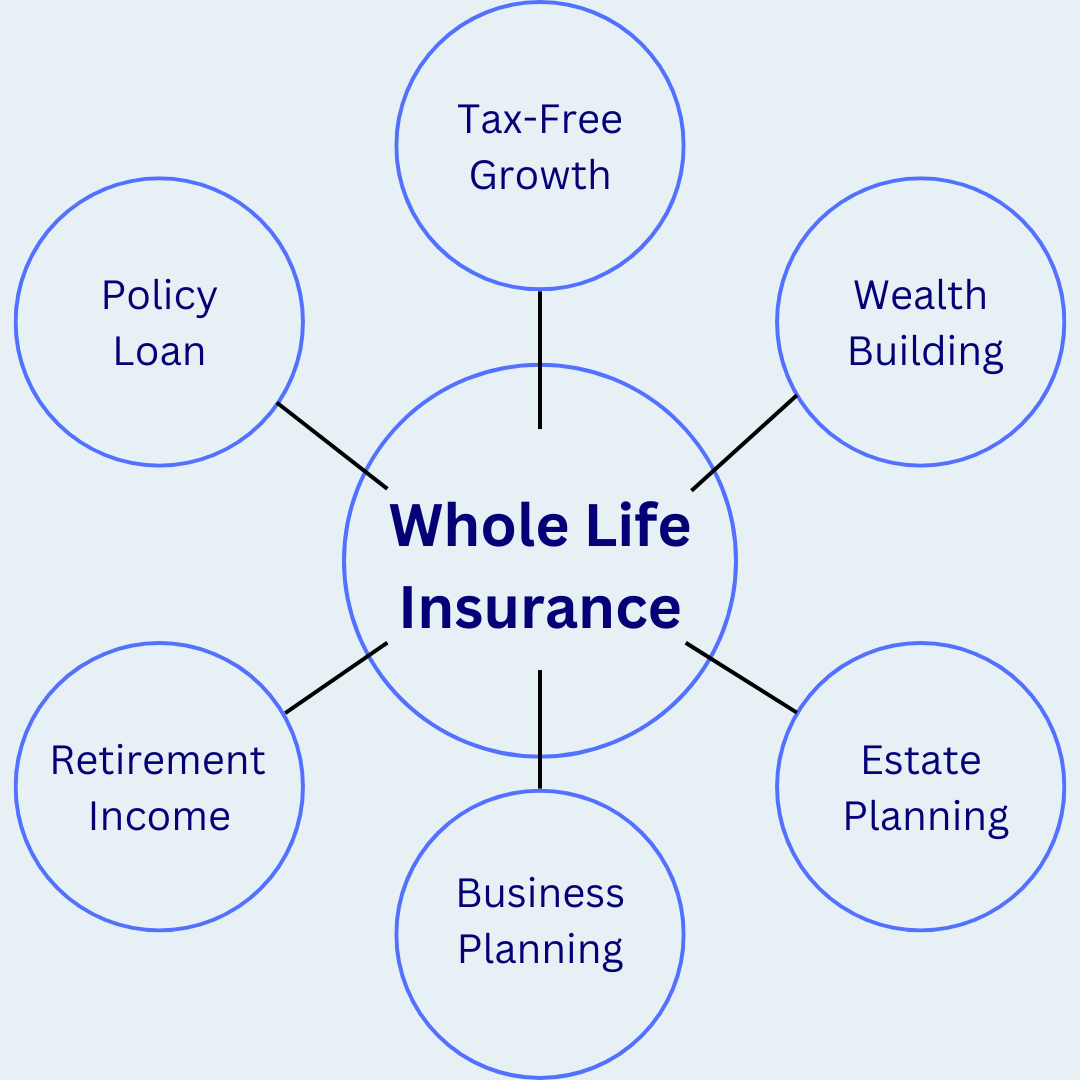

Explore advanced whole life insurance strategies to build wealth, optimize taxes, and support estate planning. Unlock sophisticated approaches for high-net-worth clients to maximize policy potential and create lasting financial legacies.

If you're new to the world of life insurance, you might have heard the term "whole life insurance" thrown around. But what exactly is it, and how does it differ from other types of life insurance? This post will break down the basics of whole life insurance for...

Are you worried about having enough money to last throughout your retirement? A guaranteed lifetime income annuity might be the solution you're looking for. In this post, we'll break down what these financial tools are, how they work, and why they might be a smart...