Explore the power of alternative investments within PPLI structures. From hedge funds to real estate and private equity, uncover how PPLI provides sophisticated investors with tax efficiency and portfolio flexibility.

Explore the power of alternative investments within PPLI structures. From hedge funds to real estate and private equity, uncover how PPLI provides sophisticated investors with tax efficiency and portfolio flexibility.

Private Placement Life Insurance (PPLI) offers a strategic solution for families looking to optimize their generation-skipping transfer tax (GSTT) planning. By integrating PPLI with tools like dynasty trusts, families can achieve tax-efficient wealth transfer, preserve assets across generations, and align investment strategies with long-term goals. Explore how PPLI can enhance your estate planning with tax benefits, flexible investments, and multigenerational legacy-building potential.

Discover how Private Placement Life Insurance (PPLI) can transform your investment strategy. Learn how this sophisticated wealth management tool offers high-net-worth investors tax-efficient portfolio growth, flexible investment options, and powerful estate planning benefits—all while maintaining investment control. Perfect for those seeking to optimize their long-term wealth preservation and growth strategies.

Private Placement Life Insurance (PPLI) investment guidelines serve as a critical framework for managing wealth while maintaining regulatory compliance. These guidelines encompass essential elements including asset class specifications, risk management protocols, compliance monitoring, and investment manager selection criteria. Successful PPLI management requires careful attention to liquidity requirements, tax efficiency considerations, and documentation standards. The guidelines must balance investment flexibility with regulatory requirements, particularly focusing on diversification under Internal Revenue Code Section 817(h). Regular reviews and updates ensure ongoing effectiveness and compliance with evolving regulations. By establishing comprehensive guidelines that address performance measurement, risk management, and implementation procedures, PPLI policies can better achieve their intended objectives while maintaining their tax-advantaged status. The success of these sophisticated wealth planning tools largely depends on the quality and thoroughness of their investment guidelines.

Private Placement Life Insurance (PPLI) is revolutionizing estate planning for high-net-worth families by combining tax efficiency and investment flexibility. Offering tax-deferred growth, income tax-free death benefits, and customizable investment options, PPLI serves as a powerful tool for wealth preservation and multigenerational asset transfer. By integrating PPLI with advanced structures like dynasty trusts and leveraging premium financing, families can optimize tax planning while protecting their legacies. With proper regulatory compliance and expert guidance, PPLI becomes a cornerstone of a sophisticated estate planning strategy, ensuring flexibility for future changes and maximizing long-term benefits.

Discover how Private Placement Life Insurance (PPLI) serves as a powerful state tax planning tool for high-net-worth individuals. This post explores how PPLI’s unique structure enables tax-efficient wealth accumulation across multiple state jurisdictions while maintaining investment flexibility. Learn about strategic asset allocation, trust integration, and practical implementation strategies that make PPLI an effective solution for minimizing state tax burdens. Ideal for wealthy individuals seeking sophisticated approaches to state tax management while preserving their investment objectives and long-term wealth accumulation goals.

Discover how wealth managers can significantly increase PPLI expenses without proportional value addition. Learn about the hidden costs, including the 1.5% annual fee that can reduce portfolio value by 25% over 20 years, and explore cost-effective alternatives to maximize your PPLI benefits while minimizing unnecessary expenses.

Private Placement Life Insurance (PPLI) offers high-net-worth individuals a powerful combination of tax efficiency and investment flexibility. However, involving wealth managers in PPLI strategies often introduces unnecessary costs and complexity. By working directly with PPLI providers, investors can potentially reduce total costs by 15-25% over the policy’s lifetime while maintaining greater control over their investment decisions. This direct approach not only streamlines communication and execution but also provides immediate access to specialized PPLI expertise without the additional layer of wealth management fees that typically range from 1-2% annually.

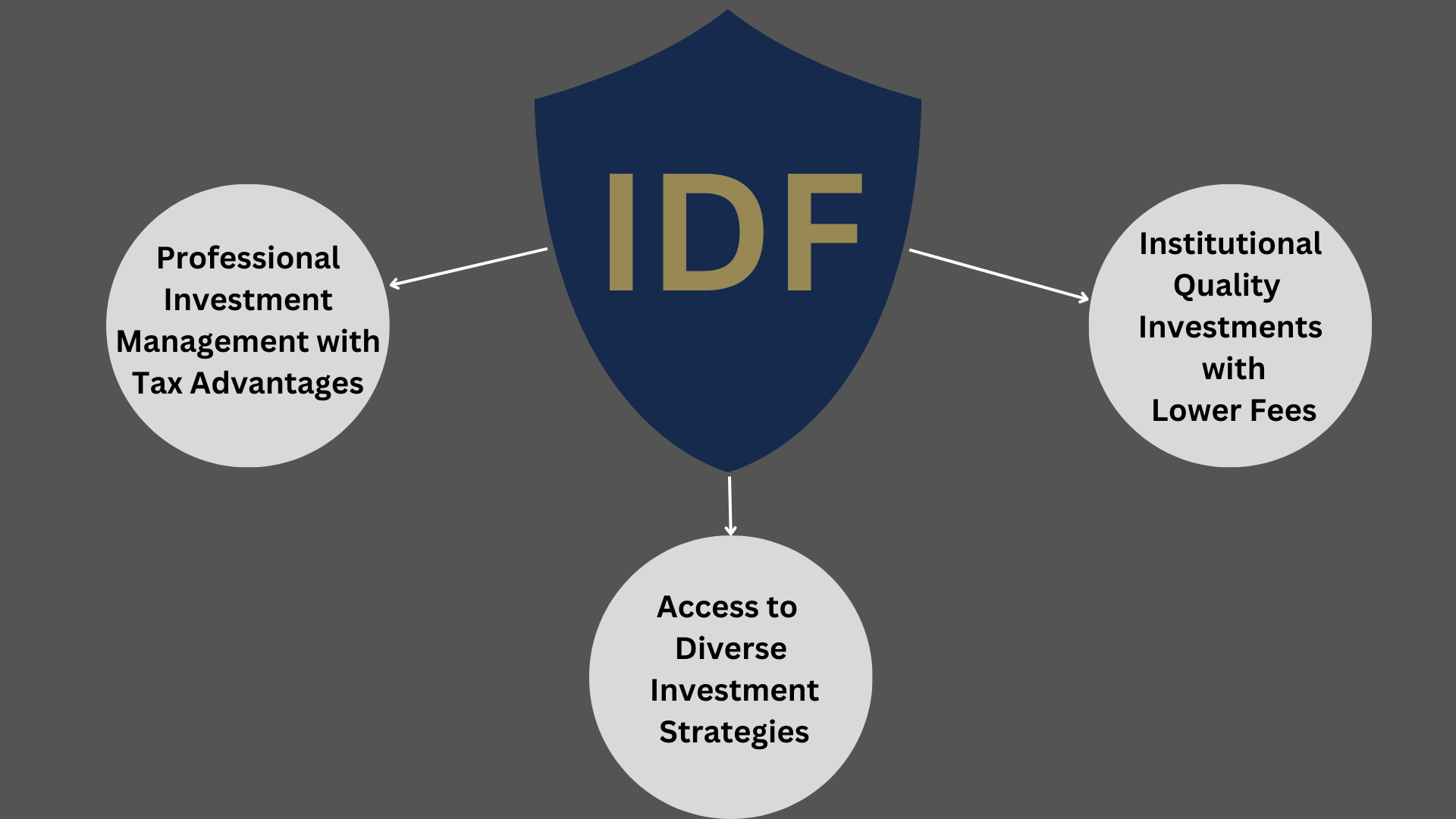

Insurance Dedicated Funds (IDFs) represent a sophisticated investment vehicle specifically designed for use within Private Placement Life Insurance (PPLI) policies. These specialized investment funds offer unique advantages for high-net-worth individuals seeking tax-efficient investment solutions while maintaining investment flexibility within their insurance policies. Unlike traditional mutual funds or separately managed accounts, IDFs must comply with specific IRS requirements to maintain the tax-advantaged status of the insurance policy. They combine professional investment management with the tax advantages of life insurance, while providing access to diverse investment strategies that might not be available in traditional insurance products. This comprehensive guide explores how IDFs work, their key benefits, regulatory requirements, and their role in long-term wealth management strategies.

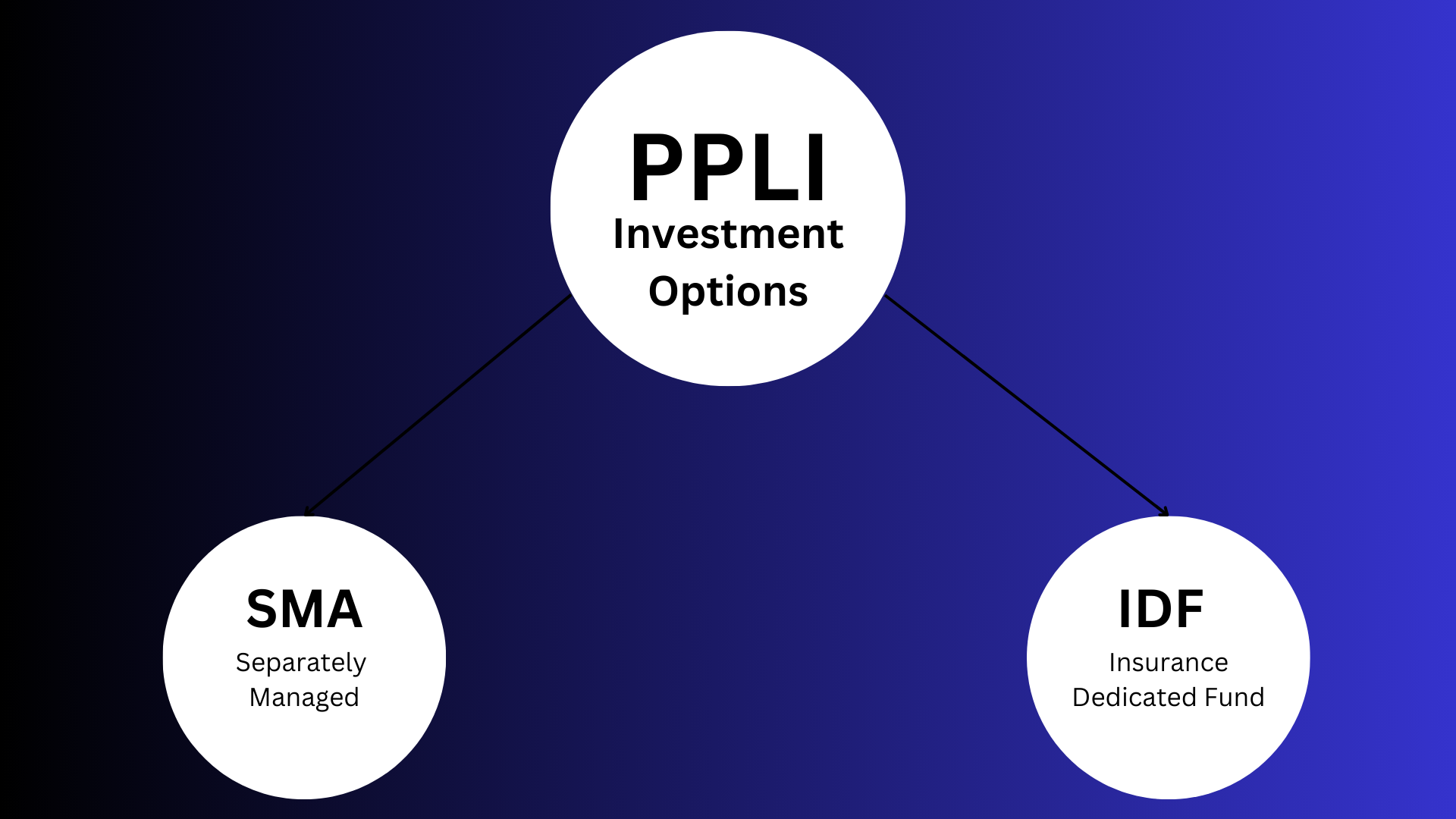

When exploring Private Placement Life Insurance (PPLI), investors face a choice between two distinct investment structures: Separately Managed Accounts (SMAs) and Insurance Dedicated Funds (IDFs). SMAs offer personalized investment portfolios with direct security ownership and greater customization but require higher minimums and management fees. In contrast, IDFs function as pooled investment vehicles with lower minimums and potentially reduced costs through economies of scale. Both structures must comply with insurance regulations, but they differ in their approach to portfolio management, risk control, and reporting transparency. Understanding these differences is crucial for selecting the right investment vehicle within your PPLI policy. While SMAs cater to investors seeking customization and direct control, IDFs may better suit those preferring standardized approaches with lower entry points. The choice ultimately depends on individual investment size, customization needs, and long-term financial objectives.

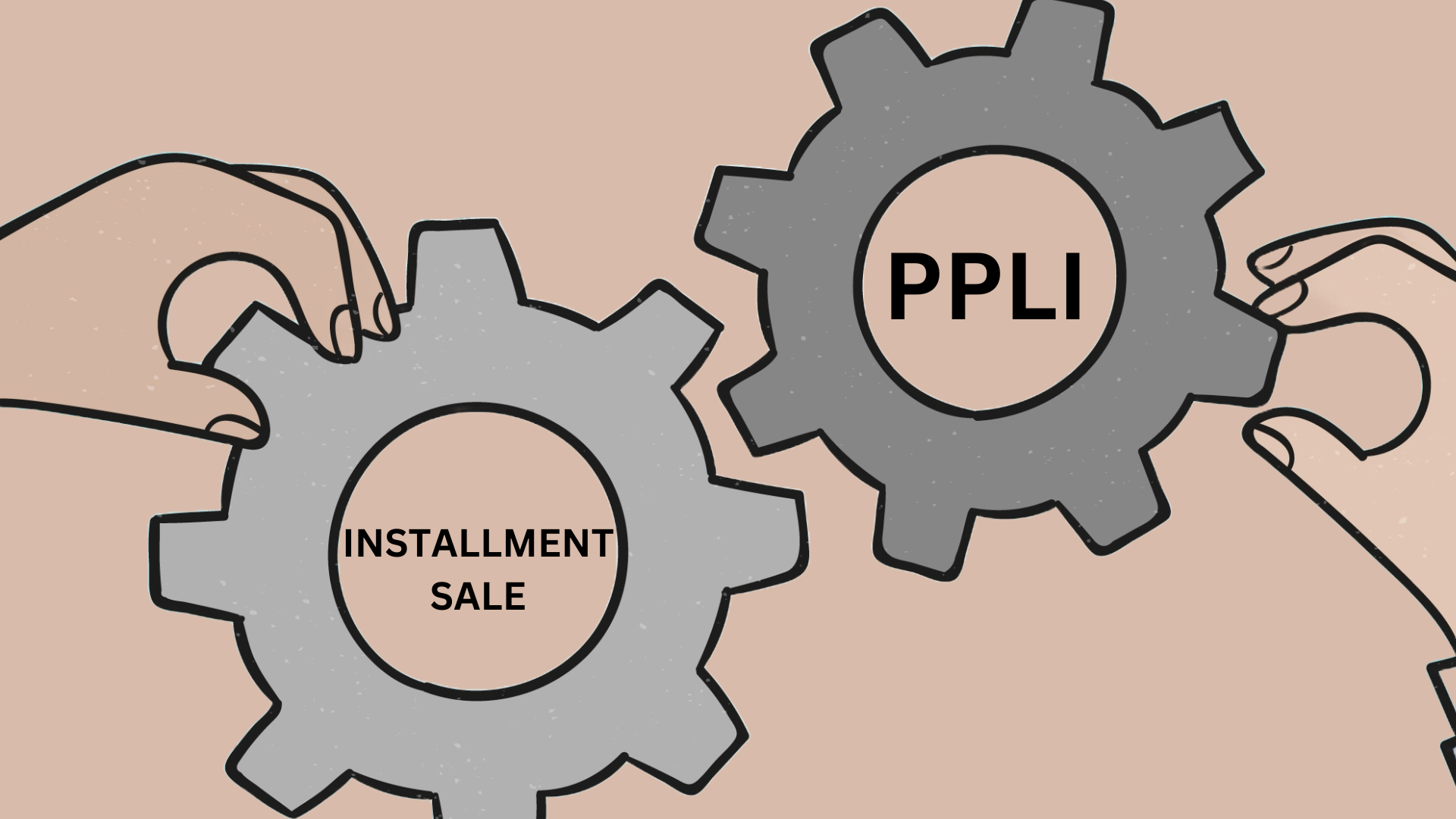

Discover the strategic advantages of combining Private Placement Life Insurance (PPLI) with installment sales for optimal wealth management. This comprehensive guide explores how this innovative approach helps high-net-worth individuals defer capital gains, create tax-efficient investment environments, and enhance long-term wealth preservation. Learn about the key benefits, implementation steps, and important considerations for successfully integrating these powerful financial planning tools.

Private Placement Life Insurance (PPLI) offers high-net-worth individuals a powerful combination of life insurance and tax-efficient investment opportunities. This comprehensive guide explores the crucial differences between offshore and onshore PPLI options, examining their unique advantages in terms of regulatory oversight, investment flexibility, and compliance requirements. Whether you’re considering domestic or international PPLI solutions, understanding these key distinctions is essential for making an informed decision that aligns with your wealth management goals.