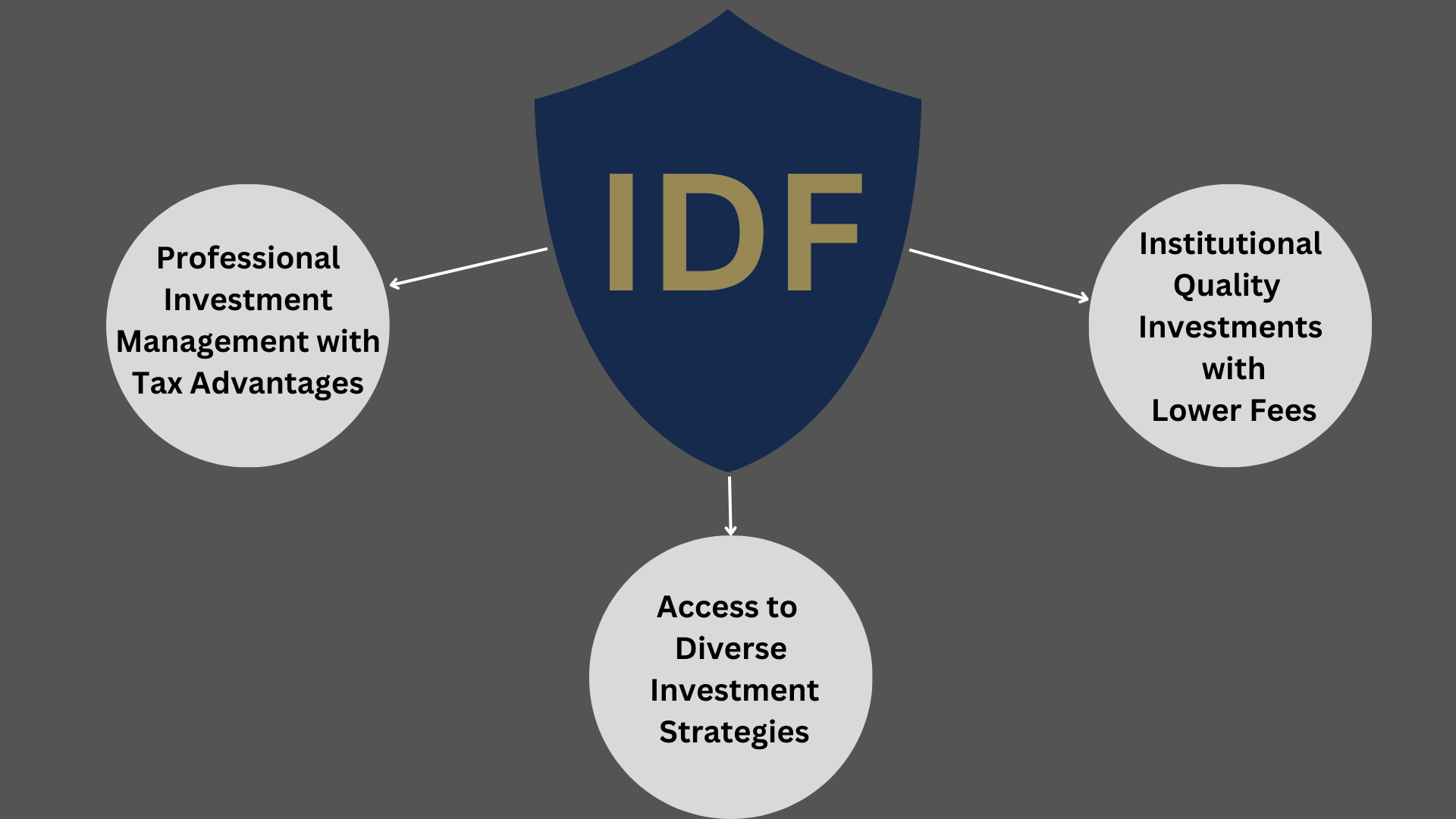

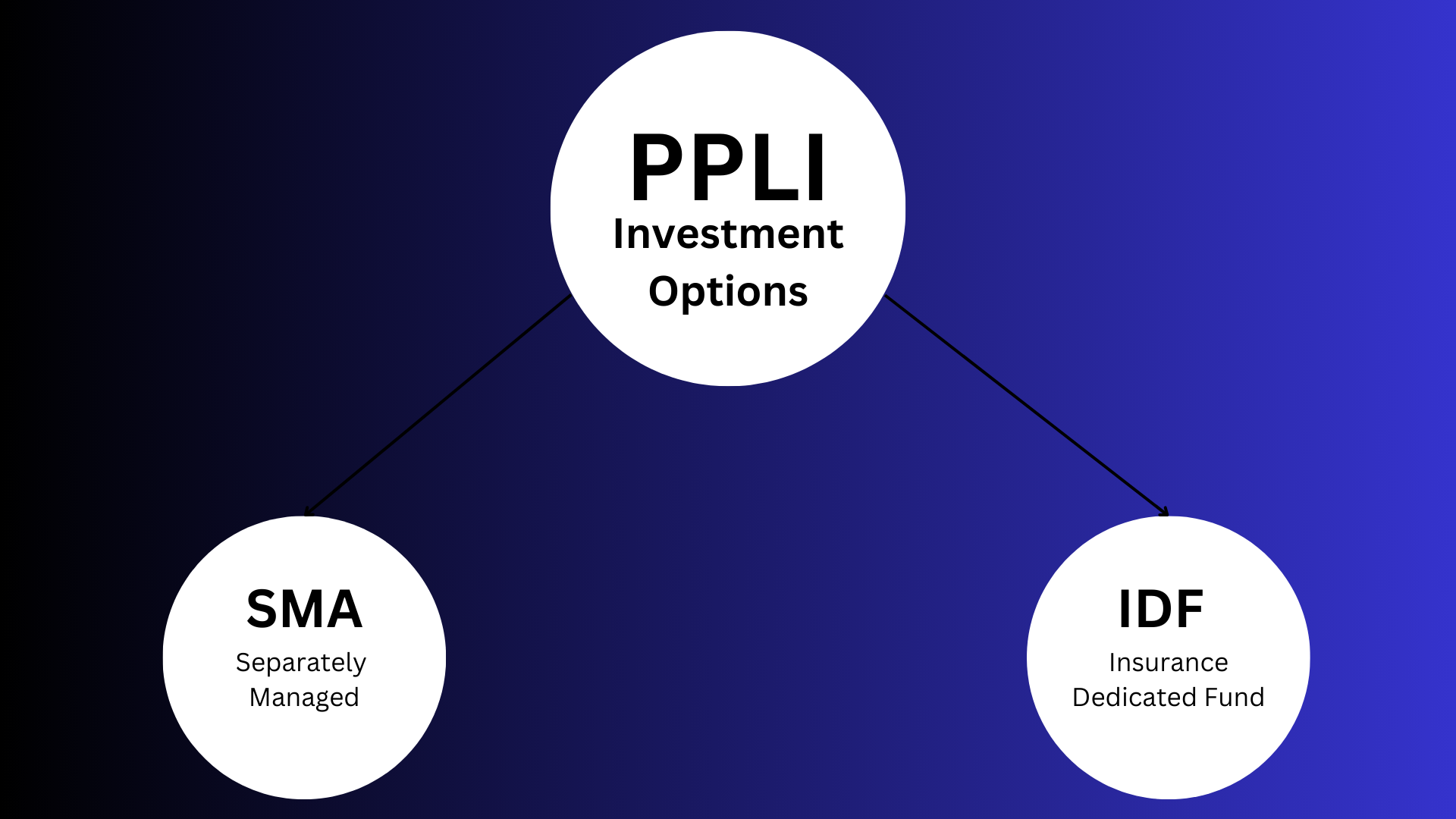

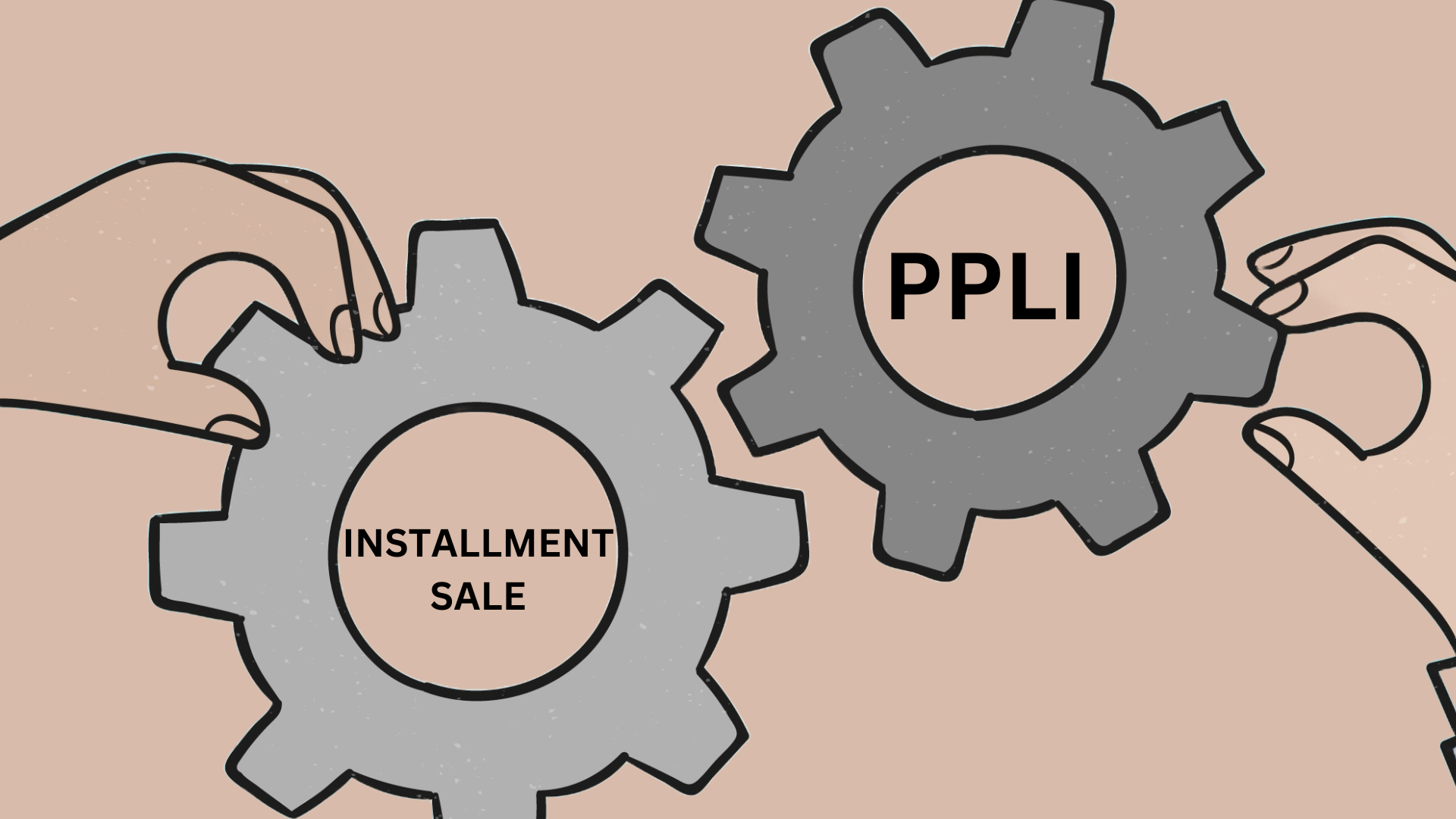

Private Placement Life Insurance (PPLI) combines the tax advantages of life insurance with sophisticated hedge fund investment strategies, offering high-net-worth investors a powerful vehicle for maximizing after-tax returns. Through PPLI structures, hedge fund investments grow tax-deferred, and when properly structured, distributions can be taken tax-free through policy loans. While implementation requires careful attention to regulatory compliance, risk management, and structural considerations, PPLI provides access to diverse hedge fund strategies via insurance-dedicated funds. Beyond tax efficiency, PPLI offers significant estate planning benefits, allowing the tax-free transfer of wealth to beneficiaries. Success with this strategy depends on thorough due diligence, proper structuring, and collaboration with experienced professionals who understand both hedge fund investments and PPLI complexities.