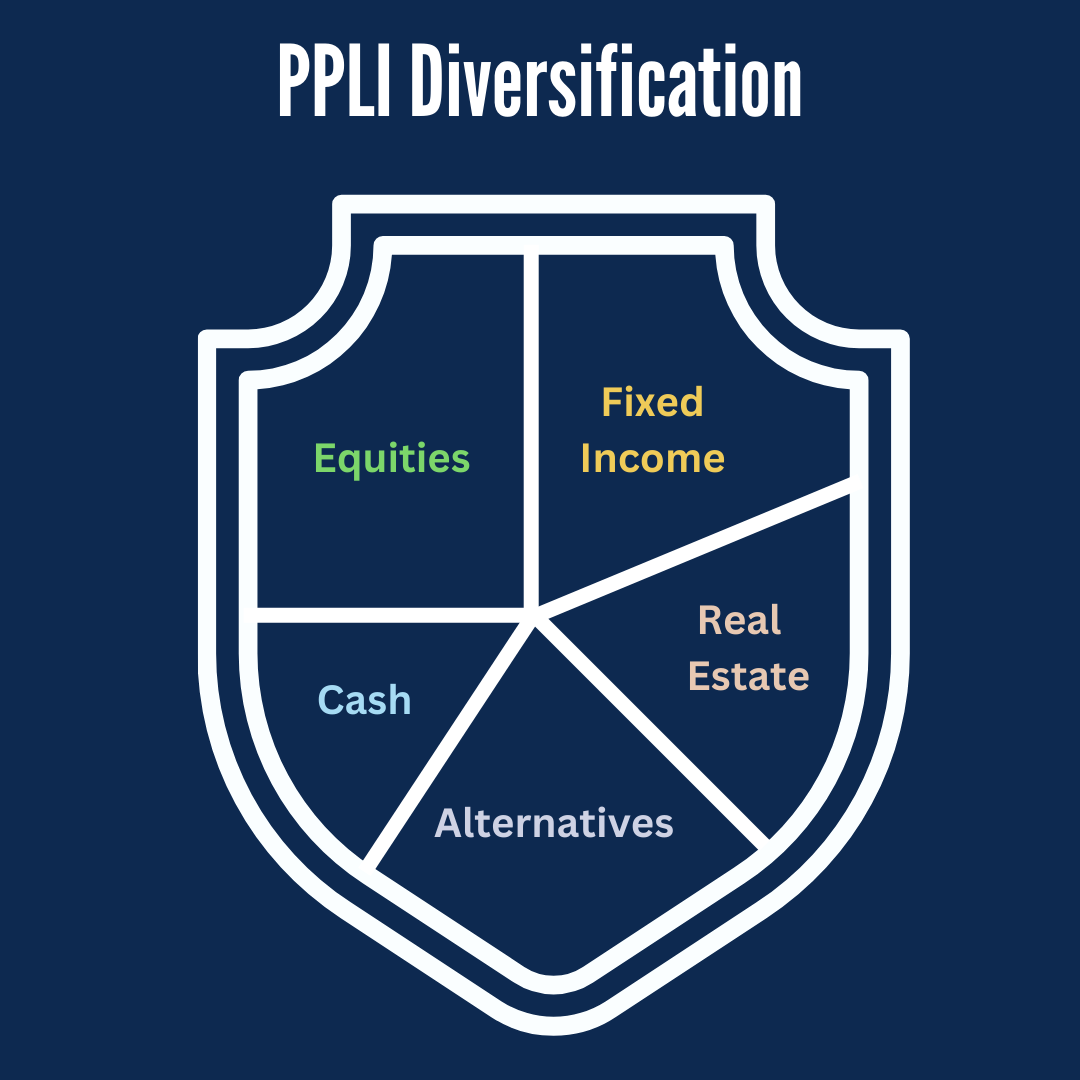

Discover the strategic considerations for PPLI beneficiary designations that go beyond basic life insurance planning. Learn how Private placement life insurance policies offer unique opportunities for tax optimization, estate planning, and wealth transfer through multiple beneficiary categories, trust structures, international arrangements, and charitable strategies. This comprehensive guide explores the flexibility and coordination required to maximize PPLI benefits for high-net-worth families.